ACCIONA, in partnership with Green of Africa and AfriquiaGaz, has officially reached financial close for the Casablanca desalination plant — a major public-private partnership (PPP) set to become both Africa’s largest desalination plant and the world’s largest powered entirely by renewable energy.

The company has also recently reached significant financing milestones in Australia, with the commercial and financial closure for Central West Orana Transmission Line project PPP, and in Peru, with the acquisition of Machupichu–Quencoro–Onocora–Tintaya transmission line project in southern area of the Country.

Casablanca Desalination Plant PPP - Project Details

Located in Sidi Rahal, within the Greater Casablanca area, the facility will provide 300 million cubic metres of desalinated water per year, responding to the growing water needs of Morocco’s economic capital and surrounding regions. Once operational, the plant is expected to serve 7.5 million people and support agricultural activities through the supply of up to 50 million cubic metres for irrigation.

Under the PPP framework, ACCIONA will take the lead on the design, build, financing, operation, and maintenance (DBFOM) of the plant for a 27-year term, in close collaboration with Morocco’s Office National de l’Électricité et de l’Eau Potable (ONEE).

The facility will employ reverse osmosis technology and draw its energy exclusively from the 360 MW Bir Anzarane wind farm, of which nearly 47% of capacity will be dedicated to powering the plant. This full reliance on renewables aligns the project with Morocco’s broader sustainability goals, setting a precedent for future infrastructure developments on the continent.

Project Timelines and Regional Impact

Construction is expected to be completed by 2028, positioning the Casablanca desalination plant as a key infrastructure asset in the region. It builds upon ACCIONA’s long-standing involvement in North African water projects, including the Fouka plant in Algeria, delivered in 2007 and still under operation.

The plant will supply potable water to Casablanca, Settat, Berrechid, and Bir Jdid, among other neighboring communities. In doing so, it will provide a vital buffer against water scarcity, a growing concern across the region, and contribute meaningfully to local economic development.

Casablanca Desalination Plant - Investment and Financial Structure

The total investment in the project stands at 6.5 billion Moroccan dirhams (approximately €613 million), with 80% structured as debt and 20% as equity. Upon financial close, the Acciona-led consortium secure funds from a mix of national and international lenders and institutions, demonstrating strong market confidence. Key financial partners include:

FIEM via ICO

Société Générale, backed by Cesce through Spain’s Green Investment Policy

Attijariwafa Bank

Banque Centrale Populaire

Bank of Africa

Caixa

COFIDES

This strong financial backing reflects not only the strategic importance of the plant for Morocco’s water security, but also the project’s attractiveness to institutions promoting sustainable development.

What is a public-private partnership (PPP) contract?

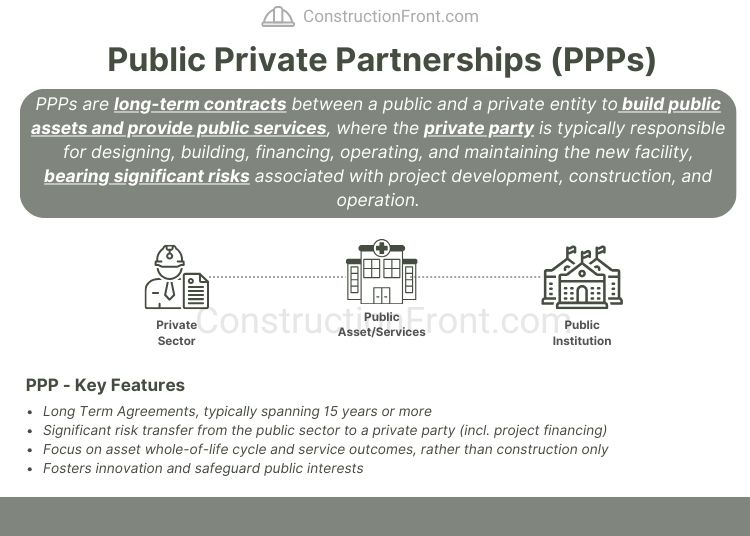

Public-Private Partnerships (PPPs) are typically long-term contracts between a government institution and a private entity for the delivery of public infrastructure and services. These services—such as hospitals, water supply systems, sewage treatment, prisons, and roads—are traditionally provided by the public sector.

In a PPP arrangement, the private party is usually responsible for designing, building, financing, operating, and maintaining the infrastructure. This model transfers significant risks to the private sector, particularly in areas such as project development, construction, and long-term operation and maintenance (read more on Public Private Partnerships (PPPs): What are they? How they Work?)

Related Project and News