ADNOC Gas has taken the final investment decision (FID) and awarded contracts totalling $5 billion for the initial phase of its Rich Gas Development (RGD) project—marking the company’s largest capital investment to date. The project is a core component of its strategy to boost EBITDA by over 40% by 2029.

The works will expand and upgrade facilities at Asab, Buhasa, Habshan, and Das Island, under an Engineering, Procurement and Construction Management (EPCM) model. This is the first of three planned phases, with future FIDs expected at Habshan and Ruwais.

Rich Gas Development (RGD) - Phase 1

Phase 1 of the Rich Gas Development project is part of ADNOC Gas’ broader plan to unlock new gas reservoirs and debottleneck existing assets to meet rising domestic and export demand. The initiative supports the UAE’s energy self-sufficiency goals and underpins the country’s petrochemical sector by ensuring reliable access to feedstock.

This initial phase involves EPCM execution across four strategic facilities—three onshore (Asab, Buhasa, Habshan) and one offshore (Das Island). In total, the works aim to increase throughput, improve efficiency, and prepare the infrastructure for subsequent capacity expansions.

The project is expected to contribute significantly to the UAE’s domestic gas supply and economic diversification goals. By developing new gas streams and improving processing capabilities, ADNOC Gas aims to support national energy security while increasing export potential through LNG.

From a local industry perspective, the project will also have a positive impact on workforce development. ADNOC Gas anticipates creating hundreds of field-based technical roles as part of its In-Country Value (ICV) commitment, reinforcing local capacity-building efforts through to 2029.

EPCM Contracts - Details

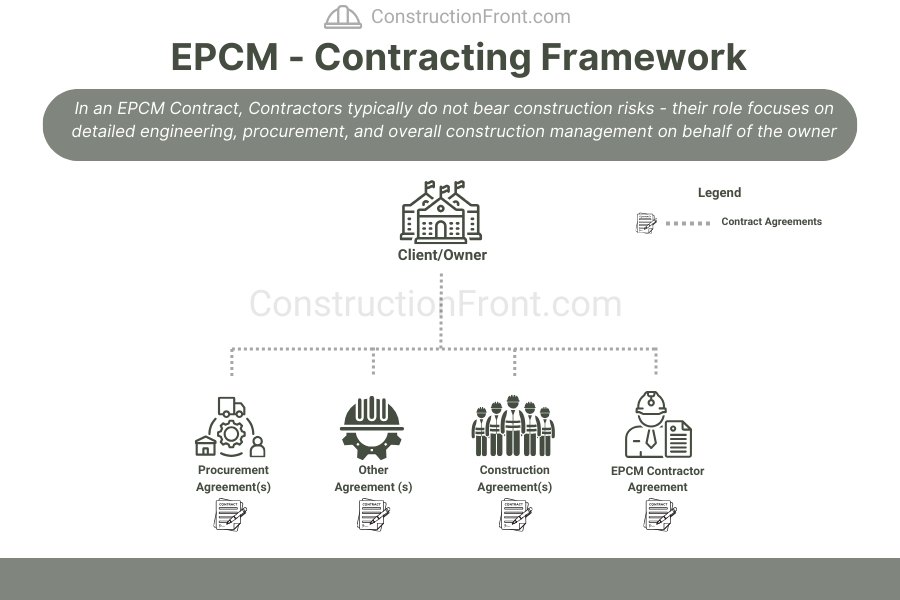

Contracts for Phase 1 have been awarded in three tranches under an EPCM framework, indicating ADNOC Gas’ preference for a delivery model that allows closer control over design and procurement, while delegating construction oversight to experienced contractors.

Tranche 1: Wood has secured a $2.8 billion contract for the Habshan facility, covering major upgrades and capacity expansion.

Tranche 2: A $1.2 billion contract for Das Island has been awarded to a consortium led by Petrofac.

Tranche 3: Kent Plc and Petrofac will also jointly deliver a $1.1 billion contract for improvements at Asab and Buhasa.

While the EPCM model allows the client to retain design ownership and better manage risk during construction, it requires strong internal capability in project management and contract administration. Given ADNOC Gas’ scale and strategic objectives, this approach aligns with the company’s goal of maintaining tight oversight on cost, schedule, and integration across its gas portfolio.

Rich Gas Development - Next Phases

With the first FID now executed, ADNOC Gas has indicated its intention to progress two additional FIDs for future phases at Habshan and Ruwais. These will build upon the capacity established in Phase 1 and are part of a long-term infrastructure roadmap.

The overall RGD development reinforces ADNOC Gas’ strategy of future-proofing its core gas assets and expanding value from existing reserves. It is also notable for its scale and integration across both onshore and offshore facilities—requiring high levels of coordination, systems integration, and stakeholder alignment across engineering disciplines.

Related Project and News

- GE Vernova to Supply Gas Turbines to Técnicas Reunidas–Orascom JV for 3GW Qurayyah IPP Expansion

- Woodside reaches Final Investment Decision for Louisiana LNG Development

- QatarEnergy awards over $6 Billion in 4 major EPC Contracts for the offshore Al-Shaheen oil field

- Siemens Energy Secures $1.6 Billion Project for Rumah 2 and Nairyah 2 Power Plants in KSA