After reaching a final investment decision for a specific project, owners will typically proceed to tender and procure the construction package, selecting a skilful contractor to deliver the works.

In the industrial construction space (i.e. energy plants, mining plants, oil and gas rigs, etc.), a prevalent contracting methodology is the EPC (Engineering-Procurement-Construction) contracts, in which owners typically transfer most of the construction phase risks to the EPC Contractor.

However, in many cases, an alternative framework is the EPCM (Engineering-Procurement-Construction Management), which can be implemented when owners wish to retain more control over design and seek more flexibility, allowing for adjustments in response to evolving project needs and intricate designs.

But what are the key differences between the EPC and the EPCM contracts?

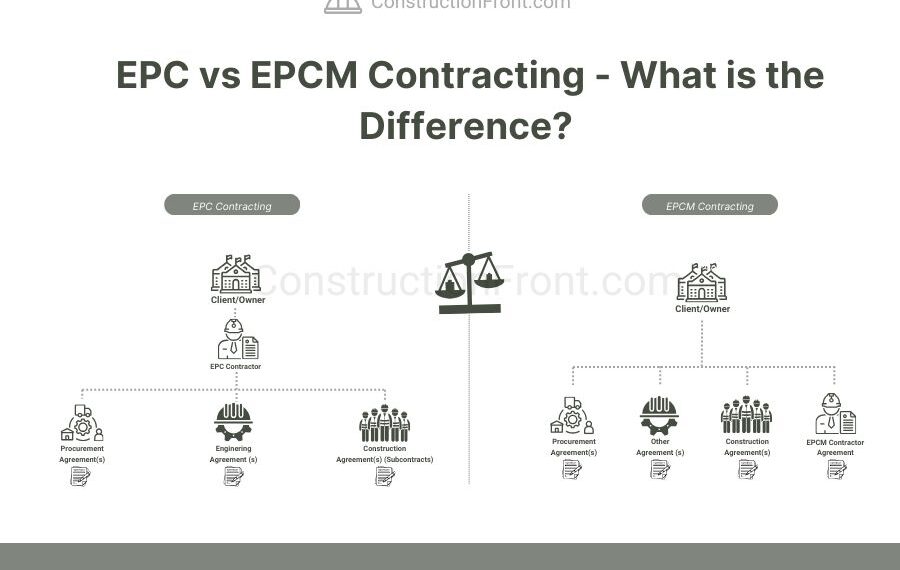

Even though they have similar names, EPC and EPCM agreements are vastly different from a commercial and risk allocation perspective – whilst in the former framework, the EPC contractor typically assumes the majority of construction risks, in the latter model, the EPCM contractor is usually hider under a professional services contract, acting in a role akin to an advisor to the client.

In this article, we will explore in detail both models, understand their key features and differences, and visit some examples. Before diving straight into the differences, let’s quickly revisit the mechanics of EPC and EPCM contracts to facility understanding.

What is an EPC Contract?

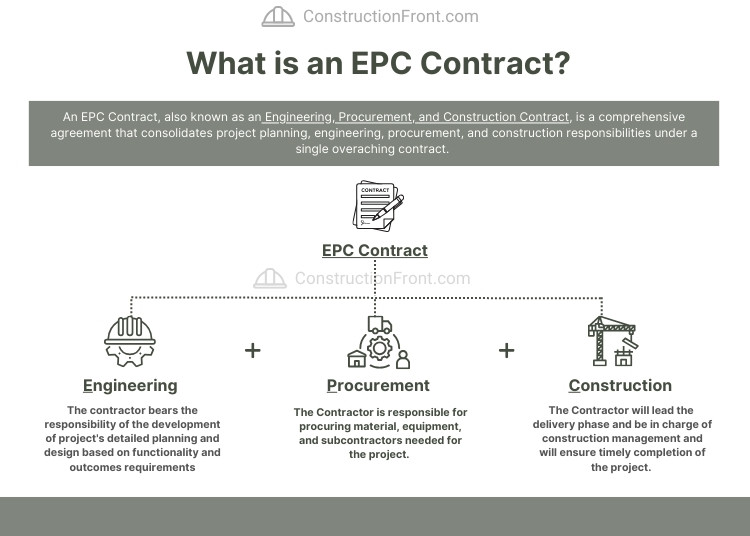

In An EPC Contract, the Contractor takes on board full responsibility for engineering, procurement and construction, bearing the majority of construction risks, such as construction delays, cost overruns, design risks, etc.

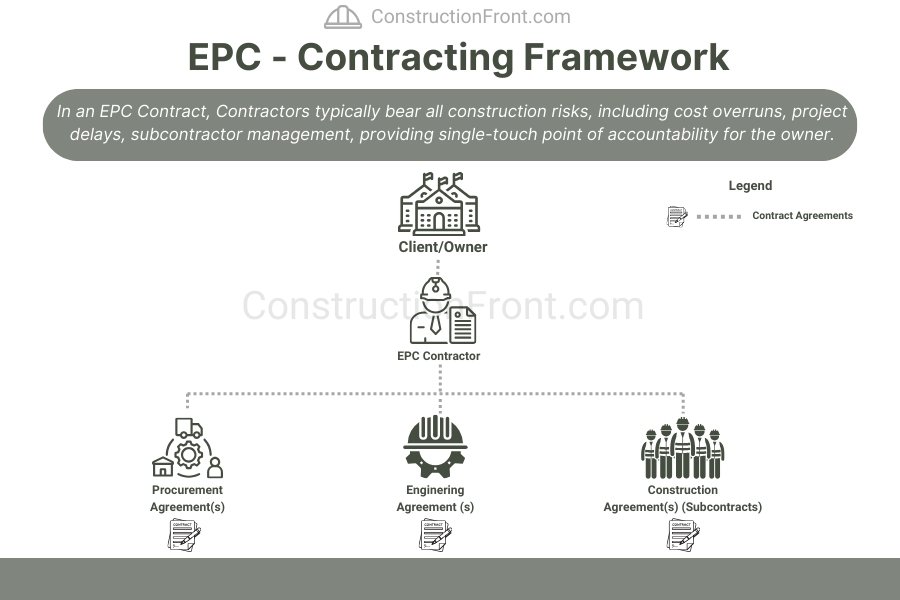

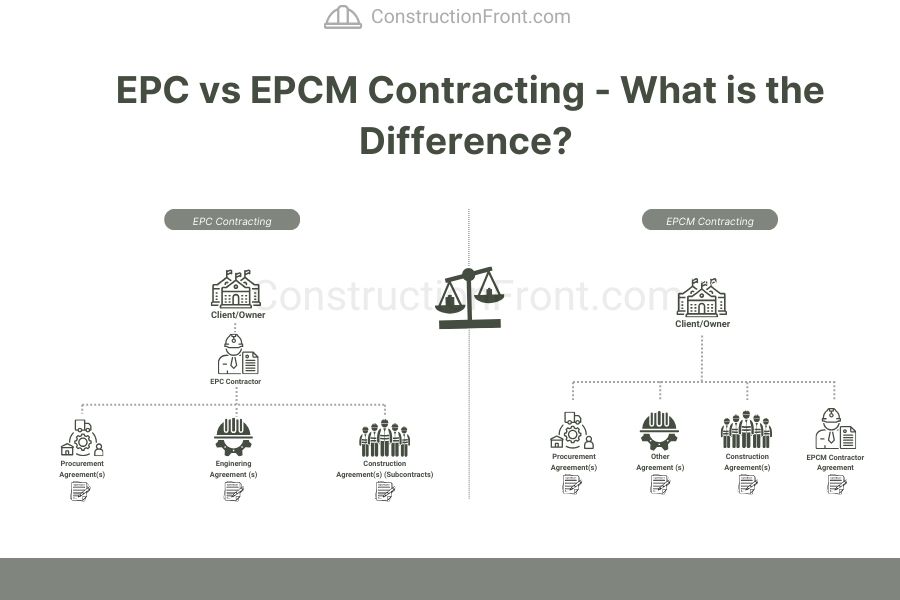

The typical commercial arrangement for EPC contracts is summarised below. From an owner’s perspective, this framework comes with several advantages for owners, including, but not limited to:

- Single-Touch Point of Accountability: The EPC contractor serves as a single point of accountability for the entire project, meaning simplified communication and coordination.

- Budget and Cost Risk Transfer: Typically, EPC contracts are executed on a turn-key lump sum basis (see note below), which means the EPC contractors ensure project completion within a specified timeline for a fixed cost, offering increased certainty for owners.

- Use of Performance Guarantees: Usually, EPC Contractors provide performance guarantees, such as performance bonds, to ensure the successful completion of the project.

Note: A “turnkey lump sum basis” contract involves the contractor taking full responsibility for the entire project, from design to completion, with the client paying a fixed, predetermined amount covering all costs. This arrangement provides cost certainty and transfers project execution risks to the contractor.

The typical commercial arrangement between the owner, contractor, and other parties in an EPC project is detailed below – the owner engages the EPC Contractor, who will manage all downstream responsibilities, including undertaking the construction works and/or subcontracting to other contractors, developing detailed engineering, and procuring all the required goods and equipment.

What is EPCM Contract?

The EPCM model is a variation of the EPC framework, and its acronym stands for Engineering, Procurement, and Construction Management.

The EPCM model has been used in sectors where engineering plays a significant role in project development, such as developing mining plants, petrochemical assets, and many other projects with ad-hoc requirements.

However, more recently, commercial frameworks similar to EPCM have also gained traction in the infrastructure/civil construction world (i.e. construction manager at risk (CMaR) in the US or ECI Contracts in the UK and Australia).

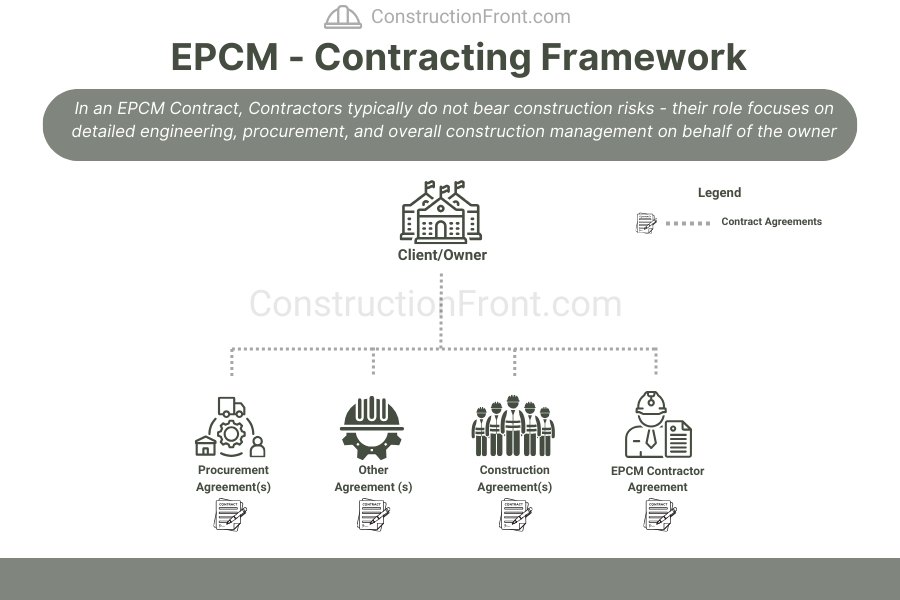

In contrast to EPC agreements, EPCM contractors typically do not take construction risks – their role is usually linked to engineering/detailed design development, support for the development of procurement packages, and overall construction management on the owner’s behalf.

As such, the EPCM Contractor’s role is akin to an advisor/professional services contractor, which has a significant commercial arrangement between the owner, the EPCM Contractor, and other third parties, as detailed in the figure below.

What are the key differences between EPC and EPCM then?

The differences between EPC and EPCM contracting are significant and should be thoroughly understood from a commercial and contractual perspective.

Whilst in the EPC framework, contractors bear considerable construction risks and typically undertake the project on a lump-sum turnkey basis, in the EPCM model, the contractor assumes a role similar to a construction/project manager, usually providing advice and guidance to the owner.

The tables and figure below summarise some of the critical differences between these two models.

Aspect | EPC Contract | EPCM Contract |

Scope | The EPC contractor is responsible for the entire construction process, including engineering, procurement, and construction. | The EPCM contractor typically provides engineering and construction management services only, construction activities sitting at owner’s responsibility (which is usually subcontracted to third parties – refer to EPCM Contracting Framework figure). |

Construction Risk Allocation | The EPC contractor typically assumes most construction-related risks, such as cost overruns and delays. | In EPCM, the owner retains more of the construction risks, including cost and schedule overruns. The EPCM contractor is not responsible for such risks, but provides its expertise to the owner to properly manage construction risks |

Subcontractor(s) Interface Risks | The EPC contractor manages and assumes the interface risks associated with subcontractors. | In EPCM, interface risks with subcontractors are legally managed by the owner, with the EPCM Contractor supporting the owner to manage them, but, ultimately, with no legal responsibility for these. |

Project Control (Influence) and Flexibility | Once the EPC contract is awarded, the owner retains less control over the construction phase, and the EPC contractor assumes “full” control over the project, making decisions related to construction sequencing and methodologies. As a consequence, owners have limited input in detailed design development and less flexibility to accommodate design changes through project development, with changes often result in additional costs through variation orders. | The owner has more control over the project, including the selection of construction contractors and greater involvement in decision-making throughout the project. Given the nature of EPCM contracts, it offers more flexibility for design changes through project development, as the owner retains control over the design, allowing for adjustments without significant additional costs. |

Cost and Time Certainty | EPC contracts typically involve a fixed price, providing cost certainty to the owner (turn-key lump sum basis). Cost overruns are borne by the contractor. These agreements often come with a fixed timeline, and the contractor is typically exposed to delay damages in case of project late completion. | Commonly, EPCM contracts do not take on board time and cost risks, with these being borne by the Owner/Client. EPCM contracts usually are typically executed on a cost-plus fee basis, or professional service contract arrangements, where contractors are paid in accordance with the volume of works managed or schedule of rate for specific resources. |

Procurement of Materials / Equipment | The EPC contractor handles the procurement of materials and equipment required for the project. | In EPCM, while the EPCM contractor may assist in procurement coordination and services, the owner will be responsible for executing the agreements and bear all the liabilities and rights to the subcontractors |

Care for Works | The EPC contractor is responsible for the care and quality of the constructed works. | The EPCM contractor is not responsible for care of works, with these responsibilities sitting under the subcontracting agreements. However, as the Construction Manager, the EPCM contractor will typically bear responsible for quality control and ensure that any quality issues are raised to the owner. |

Typical Insurances | The EPC contractor often secures insurances such as construction all-risk (CAR) insurance, performance bonds, Delay in Start-Up (DSU) Insurance or Advanced Loss of Profits (ALOP). professional indemnity, and liability insurances, etc. | In EPCM, the owner typically secures construction all-risk (CAR) insurance, with the EPCM contractor’s liability limited to professional indemnity and other specific liabilities specified in each agreement. |

Suggested Reading: What is a Variation Order? (With Templates and Examples)

When EPC and EPCM contracts are normally used?

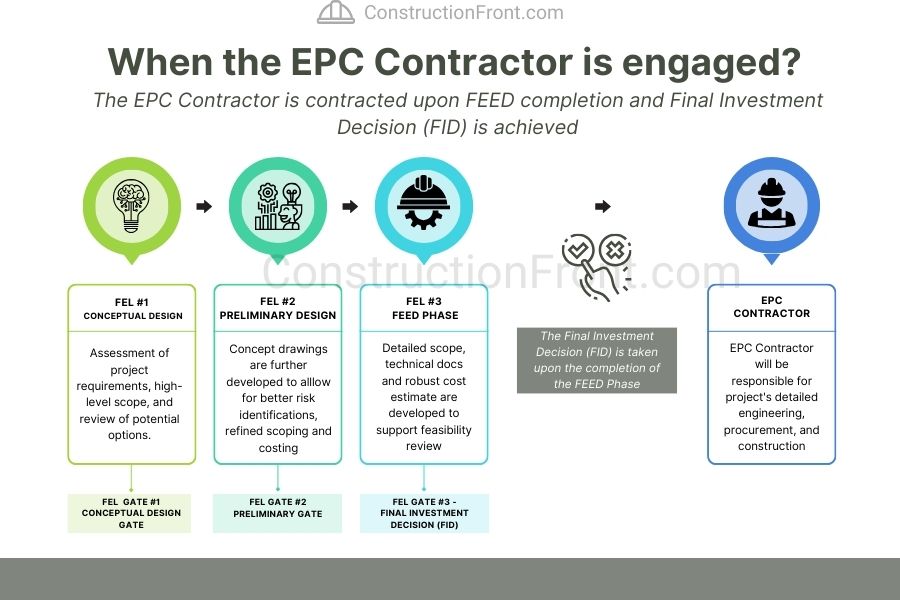

An EPC contractor or EPCM Contractor is typically engaged in projects upon completing the Front-End Engineering Desing (FEED) phase.

The FEED phase is the last step of the front-end loading process (FEL), and involves the development of basic engineering, preliminary cost estimates, and other essential documents that provide the owner with sufficient confidence to proceed to a final investment decision on the project, as detailed in the figure below.

Sometimes, FEED Contracts may include an optionality clause that, at the owner’s discretion, allows the transformation of the FEED Contractor into either the EPC or the EPCM Contractor for the project. This can benefit both parties, leveraging the enhanced project knowledge and established relationship developed during the FEED phase.

Ultimately, the choice between the EPC and EPCM frameworks will rely on several aspects, such as:

- Owner’s preference,

- Owner’s in-house capabilities,

- Contractor’s appetite,

- Market conditions,

- Total Project Costs,

- Project Financing Requirements,

- Etc.

When EPC Contracts are used?

EPC contracts are typically used when:

- Owners wish to flow downstream all the construction risks and accept limited control over project development.

- Owners do not have “in-house” skills to assume increased control over the project, nor do they wish to retain interface risks.

- Owners prefer increased protection against cost overruns, project delays, quality assurance risks, and the using multiple insurance and bonds to protect them.

- Project financing requirements – for example, banks might be reluctant to lend money to the project/owner in case EPC contracts are not used (project “bankability” is significantly affected)

EPC Contract Example - Saudi Aramco NGL Fractionation Facilities in Saudi Arabia

With an investment of more than USD 3 Billion, The Técnicas Reunidas-Sinopec Engineering Group JV was awarded a contract by Saudi Aramco to develop new facilities to fractionate 510 thousand barrels per day (MBD) of Natural Gas Liquids (NGLs) in Saudi Arabia. The project included two major EPC contracts detailed below:

Package | Description | Estimated Construction Duration |

Riyas NGL Fractionation Trains (Package 1) | Consists of two trains, each processing 255 MBD. Incorporates fractionation, treatment, dehydration, and refrigeration units. | 46 months |

Riyas NGL Common Facilities (Package 2) | Common facilities include feed and product surge storage, chemicals storage, and utilities. Utilities comprise steam and condensate recovery systems, utility water, plant and instrument air, nitrogen systems, machinery cooling water, drainage, and flare systems. | 41 months |

When EPCM contracts are normally used?

EPCM contracts are typically used when:

- Owners wish to retain increased control over engineering, procurement, and construction phases (i.e. appointment of specific subcontractors, ability to change the design as the project evolves, etc.)

- Owners have strong “in-house” capability and previous experience and feel comfortable taking increased control over the project and managing interface risks.

- EPCM Contractor is a well-respected engineering firm with solid design development accreditations, but there is limited or non-appetite to undertake construction work.

- The owner will fund the project with its balance sheet, meaning specific project financing is not required.

- Owners are looking to decrease project costs (CAPEX), given EPC contracting alternatives will usually be more expensive given the level of risk transfer.

Example - EPCM Contract - Balranald Critical Minerals project in Australia - Worley (EPCM Contractor) for Iluka Resources (Owner)

Worley has secured a contract from Iluka to deliver engineering, procurement, and construction management (EPCM) services for the Balranald Critical Minerals project in New South Wales, Australia.

Situated in the Riverina district of southwestern New South Wales, the project primarily centres on the West-Balranald deposit, abundant in rutile and zircon and houses significant quantities of rare earth minerals.

EPC vs EPCM - Which is the best option?

As detailed in this article, there is no “one-size-fits-all” answer to this question. Ultimately, the choice between EPC and EPCM frameworks will depend on:

- Nature of the Project

- Owner’s preference and ability to manage risks

- Project Financing Requirements

- Market appetite (EPC/EPCM contractor’s appetite for risks)

- Desired level of control over the project

Whilst EPC contracts offer increased risk transfer, this upside comes at increased costs for the owners and their limited ability to influence project outcomes once the EPC Contract is executed. On the other hand, EPCM contracts retain some flexibility for the owner at the expense of higher retention of construction risks and increased administrative and management burden.

The final decision should be made on an ad-hoc basis, and other factors, such as project jurisdiction, the company’s culture, and management beliefs, should be considered.

Need Help?

Do not hesitate to contact us (click here) for specialised advice in construction contracts.

Sources:

- Application of EPC Contracts in International Power Projects

- Worlds Apart: EPC and EPCM Contracts: Risk issues and allocation

- Contracting Strategies in the oil and gas industry

- Innovative Approach to Risk Analysis and Management of Oil and Gas Sector EPC Contracts from a Contractor’s Perspective

- Cost plus incentive fee contracting — Experiences and Structuring

- Is the EPCM consultant still relevant? The 4th International Platinum Conference, Platinum in transition ‘Boom or Bust’, The Southern African Institute of Mining and Metallurgy, 2010