Large-scale engineering projects are known not only for their technical complexity but also for their sophisticated commercial arrangements and funding strategies. Over time, construction contracts have evolved to become increasingly intricate in an effort to ensure that risk allocation is balanced among all parties involved, including contractors, owners, and the banking/financing sectors.

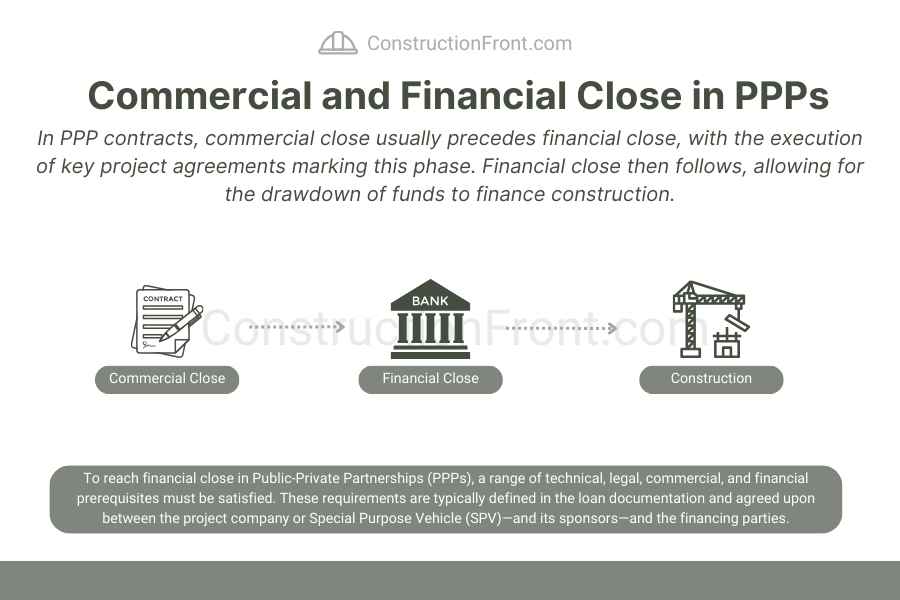

While commercial close and financial close are often closely related, especially in Public-Private Partnership (PPP) contracts, they serve distinct purposes. Commercial close typically focuses on finalizing key contract and agreements and risk allocations among stakeholders, whereas financial close is concerned with securing the necessary funding and ensuring all financial conditions are met for project development.

The timing of these processes can vary depending on project requirements, jurisdiction, contracting approach, and other project-specific factors. In this article, we will explore these concepts in more detail, examining their roles, how they impact project delivery, and the key differences between them.

What is Commercial Close?

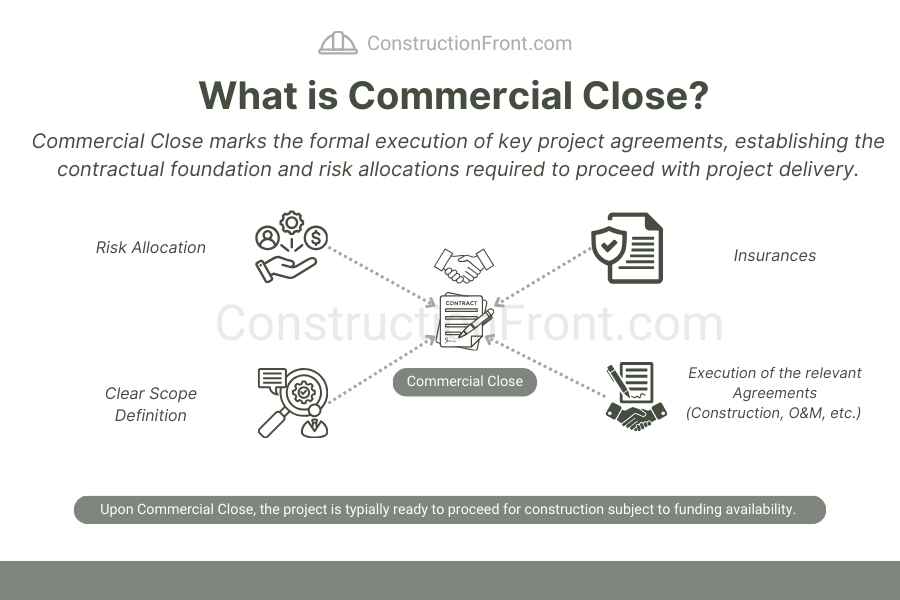

Commercial close is a pivotal milestone in the lifecycle of any large-scale engineering project. It signifies the point at which all essential agreements and contracts necessary to proceed with the project’s execution are finalized and executed by the relevant parties. Usually, upon commercial closure a formal notice to proceed can be issued to the contractor, allowing the project to move forward and construction to commence.

These agreements typically include a range of documents that cover various aspects of the project, such as the core construction agreement (e.g., EPC contracts, Design-Build contracts, Alliance Contracts, Key Supplier Agreements, Construction Manager agreements, etc.), O&M Agreements, as well as secondary agreements like insurance contracts/policies (e.g. performance bonds) and third-party/interface agreements (for example, agreements with utilities or regulatory bodies regarding site access, provision of electricity connection, etc.).

A key objective of commercial close is to clearly define the roles and responsibilities of all stakeholders. This includes outlining the scope of work, project timelines, quality standards, and the allocation of risks. It ensures that potential risks—whether technical, financial, or operational—are assigned to the parties best positioned to manage them.

For example, risks like project delays, cost overruns, and unforeseen site conditions (such as latent conditions) are mitigated through specific contract clauses. These might include liquidated damages to compensate for delays and performance bonds to guarantee project completion.

In the context of Public-Private Partnerships (PPPs), commercial close serves as the foundation for moving forward with the project. It establishes the terms under which work will proceed and sets the basis for raising the necessary debt to fund the project. Without these agreements in place, the project cannot progress to financial close, as financial institutions and investors require clarity on the project’s risks and contractual obligations before committing funding.

What is Financial Close?

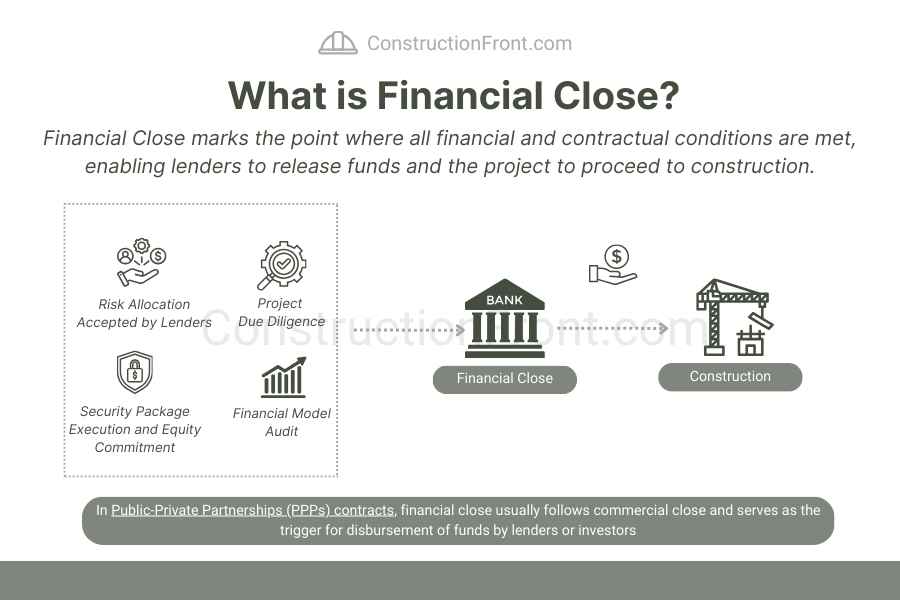

Financial close is a critical milestone in the delivery of large-scale engineering projects, marking the point at which all funding arrangements are secured, and the financial structure underpinning the project becomes legally binding. While commercial close establishes the contractual framework for project delivery, financial close ensures that the capital required to execute the project is fully committed and available.

At financial close, all financing documents are executed, and all conditions precedent to the initial drawdown of funds are satisfied. These conditions often include the completion of due diligence, finalisation of risk allocation through contract documents, regulatory approvals, and the establishment of security packages and financial guarantees.

In Public-Private Partnerships (PPPs) contracts, financial close usually follows commercial close and serves as the trigger for disbursement of funds by lenders or investors. The private party (typically a project company or consortium – a.k.a. the Special Purpose Vehicle or SPV) will have secured commitments from debt providers—such as commercial banks, development banks, or bond markets—and equity investors, creating a bankable structure that satisfies the requirements of all financial stakeholders.

Importantly, financial close also signals the beginning of the project’s financial reporting and compliance obligations. Lenders will typically impose ongoing monitoring requirements, performance reporting, and possibly reserve accounts or cash flow controls to protect their interests throughout the construction and operational phases.

In projects that are not structured under a PPP model, such as EPC or D&C contracts backed by project finance or corporate finance arrangements, financial close similarly marks the point at which funding becomes available, enabling full-scale mobilisation of resources to progress on project development.

Without financial close, a project may remain contractually ready but financially unviable. It is only once both commercial and financial closes are achieved that a project can truly proceed into its delivery phase with certainty and financial backing in place.

Commercial vs Financial Close - Key Differences

The table below summarises the key differences between commercial and financial close:

Aspect | Commercial Close | Financial Close |

Definition | Execution of key project agreements necessary for project delivery | Execution of financing agreements and satisfaction of conditions to fund the project |

Purpose | Establish the contractual and risk framework for the project | Secure capital and enable drawdown of funds |

Key Agreements | Construction contracts, interface agreements, insurance, etc. | Loan agreements, security documents, equity funding agreements |

Trigger | Finalisation and signing of commercial documentation | Fulfilment of all conditions precedent for financial disbursement |

Typical Output | Notice to proceed for construction can be issued, if funding is available. | Initial drawdown of funds and commencement of financial obligations |

Key Stakeholders Involved | Owner, contractor(s), insurers, third-party agencies | Owner/SPV, lenders, equity investors, financial advisors, insurers |

Typical Sequence for PPP projects | Occurs before financial close | Occurs after commercial close |

Common in PPP Projects | Yes – forms the basis for raising debt | Yes – lenders require commercial close to assess bankability |

Key requirements for Financial Close in PPPs

To reach financial close in Public-Private Partnerships (PPPs), a range of technical, legal, commercial, and financial prerequisites must be satisfied. These requirements are typically defined in the loan documentation and agreed upon between the project company or Special Purpose Vehicle (SPV)—and its sponsors—and the financing parties.

A core purpose of these requirements is to provide lenders and investors with confidence that the project is contractually secure, technically feasible, and financially sound. In practice, this involves extensive due diligence and the submission of detailed supporting documentation.

Typical requirements for financial close may include:

- Executed Project Agreements: All major project contracts must be fully executed and in a form acceptable to lenders. This includes the construction contract, O&M agreement, and key supply/offtake agreements (where applicable).

- Lender Due Diligence: Independent technical, legal, financial, and insurance advisors must complete their assessments and issue final due diligence reports. These reports validate that the project’s risk profile, delivery strategy, and revenue assumptions are acceptable.

- Financial Model Audit: A robust, lender-approved financial model must be submitted and independently audited. The model should demonstrate the project’s financial sustainability across various scenarios.

- Permits and Approvals: Evidence that all critical planning permissions, environmental approvals, and regulatory consents have been secured.

- Equity Contributions: Sponsors may be required to inject their committed equity into the project before or concurrently with financial close.

- Execution of Security Package: This includes the signing and registration of key finance documents such as loan agreements, direct agreements, shareholder agreements, and the creation of security interests over project assets and bank accounts.

- Insurance Coverage: Confirmation that all required insurance policies for both construction and operations have been placed and meet lender requirements.

- Satisfaction of Conditions Precedent (CPs): All CPs outlined in the financing agreements must be satisfied or formally waived. These may include documentation deliverables, regulatory confirmations, or project readiness milestones.

In complex infrastructure projects—especially those delivered through PPP or project finance structures—meeting these requirements can take several weeks or months following commercial close. Nevertheless, they are essential to ensure that all foreseeable risks are addressed and that financing parties have the certainty needed to proceed with fund disbursement.

Conclusion

Commercial close and financial close represent two critical steps in the journey of delivering a large-scale engineering project. While they serve different purposes, they are closely connected and equally essential to a project’s success.

Commercial close provides the contractual certainty needed to move forward — setting out the roles, responsibilities, and risk allocations for all parties involved. Financial close, in turn, builds on that foundation by making the necessary funds available for project development. It confirms that the project is financially viable, that all key approvals and conditions are in place, and that lenders have the confidence to proceed with disbursement.

Reaching these milestones doesn’t just mark progress — it gives all stakeholders the clarity and assurance needed to proceed with confidence. When done well, they lay the groundwork for a more stable and predictable project delivery.

Need Help with Commercial or Financial Close?

Do not hesitate to contact us (click here) for specialised advice in the construction industry.

Sources

- The financial close process: Implications for future research

- Coming to Financial Close in PPPs: Identifying Critical Factors in the Case of Toll Road Projects in Indonesia

- Best Practice for Financial Models of PPP Projects – ScienceDirect

- Risks and the financing of PPP: Perspectives from the financiers

Disclaimer: The articles on this blog are for informational and educational purposes only and do not constitute legal advice. While we strive to provide accurate and up-to-date information on construction law, regulations may vary by jurisdiction, and legal interpretations can change over time.