In many industries and corporations, the decision to develop and proceed with capital projects (e.g., the construction of a power plant, upgrades to an existing facility, construction of a new mining plant or oil and gas offshore platform) is typically underpinned by multiple engineering, commercial, and feasibility studies.

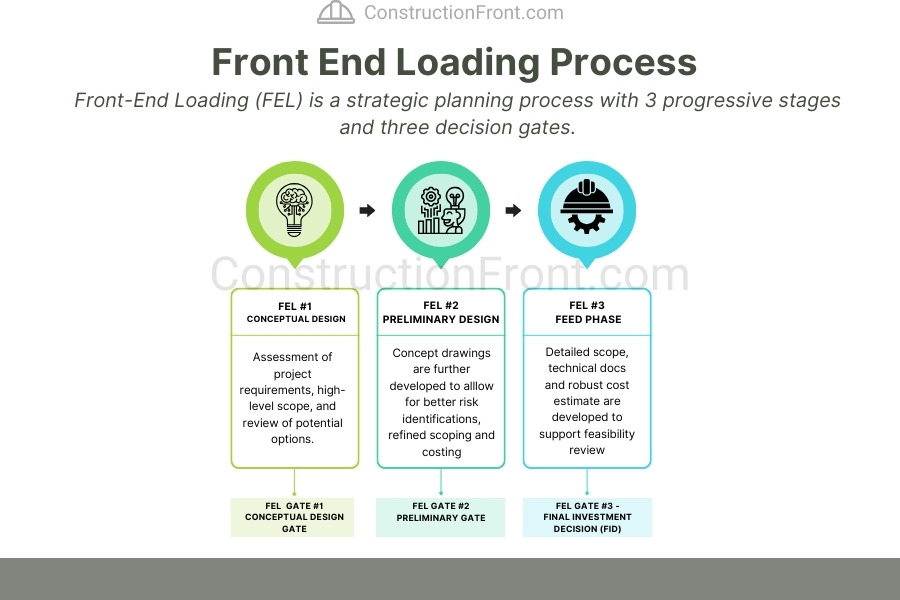

The Front End Loading (FEL) Process is the most used project development methodology among many existing p alternatives. FEL is a gate-staged process with three significant steps and associated decision gates:

Stage | Decision Gate |

Concept Design | #1 – Conceptual Gate / Concept Study |

Preliminary Design | #2 – Preliminary Gate / Feasibility Study |

#3 – Final Investment Decision |

But what exactly does the Final Investment Decision mean? Simplistically, the Final Investment Decision (FID) is the formal approval from a project developer to proceed with a specific project, marking the commitment to allocate capital resources and move from the project planning stages to execution (Implementation/Construction Phase).

This article will explore FID further, understand its relevance for project development and the construction industry, how it works, detail some real examples and discuss key features around FID – keep reading.

What is the Final Investment Decision?

Before digging into the details of the FID, it is essential to understand in which context it is used – the Front End Loading (FEL) Process. The section below briefly summarises how FEL typically occurs, noting that some adjustments are made according to industry and specific project requirements.

Front End Loading Process - A brief overview

Front-End Loading (FEL) is a strategic planning process for intricate engineering projects such as oil rigs, manufacturing, mining, and energy plants. It comprises three progressive stages, which are associated with “go/no-go” decisions upon completion (decision gates – see table and picture below):

Stage | Activities Undertake (high-level summary) | Decision Gate |

Stage 1 – Concept Design | Review of Project Requirements, Review of Constructability aspects, Preliminary Concept Design, Preliminary Flow Diagrams (plants) Preliminary Cost Estimate | #1 – Conceptual Gate |

Stage 2 – Preliminary Design | Preliminary Work Breakdown Structure (WBS) ,Further Constructability Review, Detailed project requirements, Concept design development ( including dimensions, areas, arrangements, etc), Key equipment and resource list, Refined Cost Estimate | #2 – Preliminary Gate |

Stage 3 – Front-End Engineering Design (FEED) | – Detailed Scope of Work, Basic Engineering Documents and Technical Specifications, Robust Cost Estimate, Procurement Packages to proceed for Construction Phase (varies based on contracting approach) | #3 – Final Investment Decision |

The FEL approach offers several advantages, including, but not limited to:

1. Risk Mitigation: FEL helps identify and mitigate risks early in the project life cycle, reducing uncertainties during later stages.

2. Cost Savings: Early planning and feasibility studies in FEL lead to accurate cost estimates, preventing costly changes during construction.

3. Project Viability: FEL ensures a comprehensive evaluation of project requirements, enhancing overall project viability and success.

4. Decision Gateways: FEL is gate-staged, allowing periodic reviews and informed decision-making on project progression.

FEL Gates and the Final Investment Decision (FID) gate

The Front-End Loading (FEL) process typically includes three decision gateways, at which critical decisions are made on whether to proceed to the next stage or halt the project, as detailed below:

Decision Gate | Key Review Aspects | Timing |

#1 – Conceptual Gate |

| End of FEL stage 1 – Concept Design |

#2 – Preliminary Gate |

| End of FEL Stage 2 – Preliminary Design |

#3 – Final Investment Decision |

| End of FEL Stage 3 – FEED |

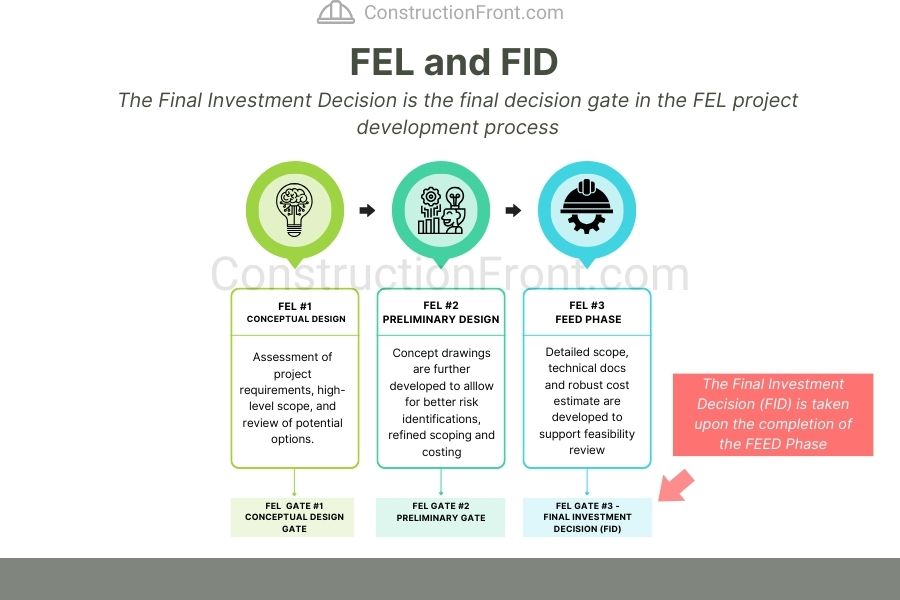

What is the Final Investment Decision?

The Final Investment Decision (FID) is the third and final decision gate in the Front End Loading (FEL) process and occurs at the end of the Front-End Engineering Design (FEED) phase (or FEL Stage 3).

The FID represents the formal commitment by senior management or project stakeholders to proceed from the planning stages to the implementation/construction phase. It marks the point at which significant financial resources are allocated or are committed to be allocated to move the project from planning to implementation.

As detailed above, the decision is based on a comprehensive evaluation of the detailed scope of work, essential engineering documents, technical specifications, robust cost estimates, preliminary feasibility and funding studies, and procurement packages developed during the FEED phase.

Final Investment Decision - How it works? What Happens once FID occurs?

The FID process is crucial for de-risking projects and ensuring they are economically viable and technically feasible before committing to substantial investments in construction and development.

The FEL process leading to FID involves a thorough evaluation of various factors, and it typically considers the following aspects:

1. Robustness of Project Planning: During the Front-End Engineering Design (FEED) phase, detailed planning is undertaken, including developing a comprehensive scope of work, technical specifications, construction/implementation program, and cost estimates. Senior Management typically “stress” test scenarios to understand risk exposure and ensure the project is viable.

2. Risk Assessment: A thorough risk assessment is conducted, considering factors such as technical feasibility, market conditions (e.g. financing needs, interest rates, cost of capital), resource availability (e.g. lead time for specific parts of a power plant), regulatory compliance, and potential legal challenges (e.g. environmental regulations).

3. Financial Evaluation: The project’s financial aspects are carefully evaluated, such as including the potential funding sources (e.g. ability to raise equity and debt for the project), optimal capital structure (debt-equity ratio), insurance requirements, and potential returns on investment (ROIs)

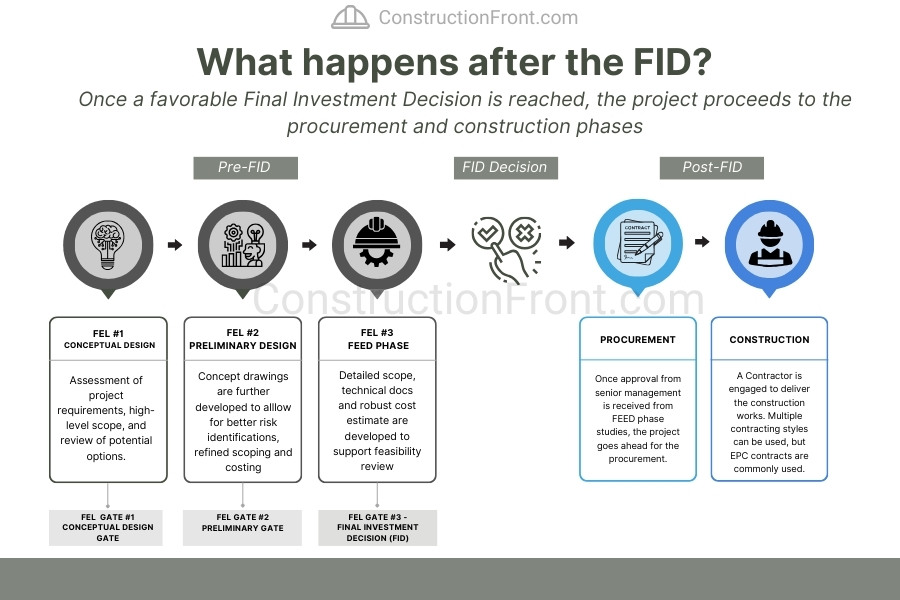

Once a favorable Final Investment Decision is reached, the project proceeds to the procurement and construction phases. The project owner might also pursue and secure debt financing depending on the capital structure.

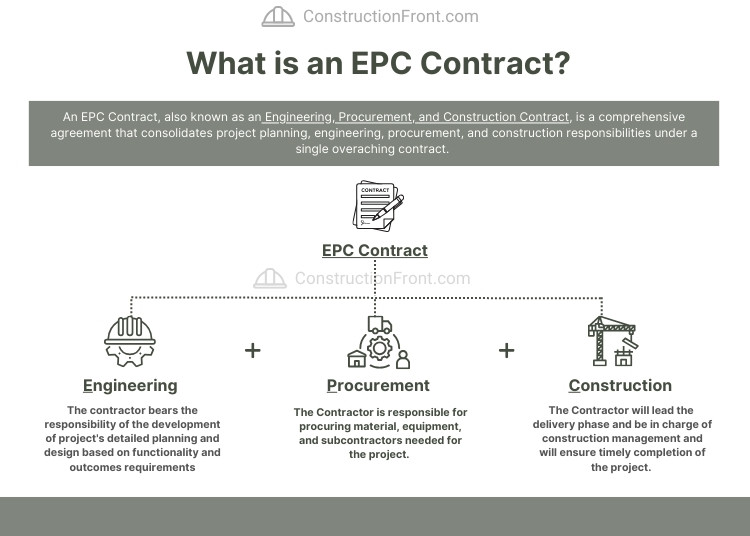

EPC have similar characteristics to the managing contractor framework, but with a wider scope, since the contractor also bears full the responsibility of engineering and procurement, as detailed below.

Project Procurement and Construction Agreements

Once a project owner decides to proceed with the project implementation/construction, it will typically engage with the market and procure a qualified contractor to deliver the works.

Many contracting framework alternatives are available, and the choice relies on the desired level of risk transfer. For significant projects, EPC (Engineering-Procurement-Construction) contracts are commonly implemented.

In the EPC contracting, the contractor is responsible for further developing the design package produced under the FEED phase (pre-FID), procuring subcontractors and required equipment, and overseeing the entire construction process (see picture below).

There are many advantages associated with this framework, such as a single touch point for the client and increased risk transfer – we suggest reading our detailed article on EPC contracts.

Suggested Reading: What is an EPC Contract? (Key Features, Examples, and Tips)

Apart from EPC, many other contracting alternatives are available, including:

Contract Type / Style | Description | Common Application |

EPCM – Engineering, Procurement, and Construction Management | The EPCM is a variation of EPC and stands for Engineering, Procurement, and Construction Management; in this case, the EPCM Contractor acts more like an advisor to the owner, helping and supporting the client in making key decisions. | Alternative to EPC contracting, when owner wishes to retain increased control over the project decisions. |

D&C contracts involve a single entity handling both design and construction phases for projects with relatively simple design needs. | Projects with straightforward design requirements for streamlined design and construction. | |

Managing Contractor / General Contractor | Managing contracts takes the role of a project managers for comprehensive oversight, coordination, and decision-making throughout the project lifecycle. | Projects needing comprehensive project management for coordination and decision-making. |

Alliance contracts prioritize collaboration, risk-sharing, and a cooperative approach among stakeholders in executing complex projects. | Complex projects emphasizing collaboration, risk-sharing, and cooperative stakeholder approach. | |

CMAR contracts involve a construction manager engaged early, providing input on construction aspects and risk management in complex projects. | Complex projects requiring early construction input and effective risk management (more common in civil infrastructure projects) |

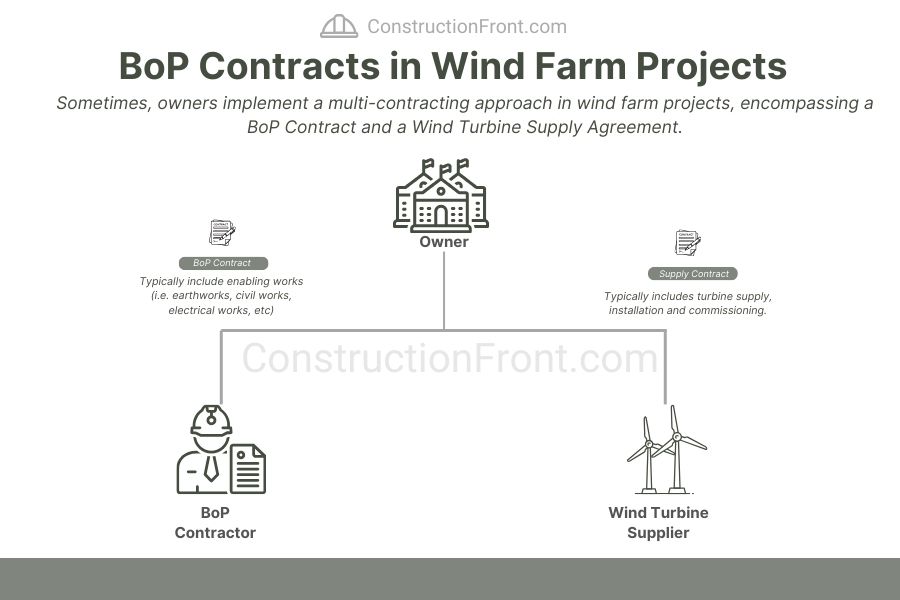

In some instances, in energy and processing plant projects, for a wide variety of reason might split the EPC contract scope into two major contracts:

- a Balance of Plant Services (BOP); and

- an Equipment Supply Agreement (also named Original Equipment Manufacturer – OEM).

For instance, this approach is very common in wind farms, where owners might decide to pursue optimized risk allocation and cost savings (read this article for further details: Balance of Plant (BoP) Contract: What is it? How it Works?).

Ultimately, the best contracting approach is subjective and depends on project risks, desired level of risk transfer, market appetite, project complexity, financing requirements, client preferences, etc.

FEED and EPC Contracts - Notice to Proceed

Commonly, FEED agreements have specific clauses that enable the owner, at its discretion, to enact an option to take the FEED Contractor as the EPC Contractor in case a project reaches a favourable FID.

When executed, these clauses ensure continuity and familiarity with project details, facilitating an efficient transition with reduced risks and streamlined decision-making. Having been involved in the initial design, the EPC contractor can optimize construction plans, enhance design quality, and maintain cost efficiency.

Typically, the process is formalized via a Notice to Proceed, by which the owner formally instructs the FEED Contractor to become the EPC contractor and proceed with the construction works.

Author’s Note:

In the context of civil infrastructure projects, the FEED-EPC contractor dynamics are similar to what is seen in Early Contractor Involvement Agreements (Common in the UK and Australia) or CM/GC contracting approach (common in the US), in which the contractor helps with project development, and, eventually becomes the construction contractor.

For further details, read: What is an ECI Contract? (And How It Works)

Final Investment Decision (FID) vs Financial Close - What is the difference?

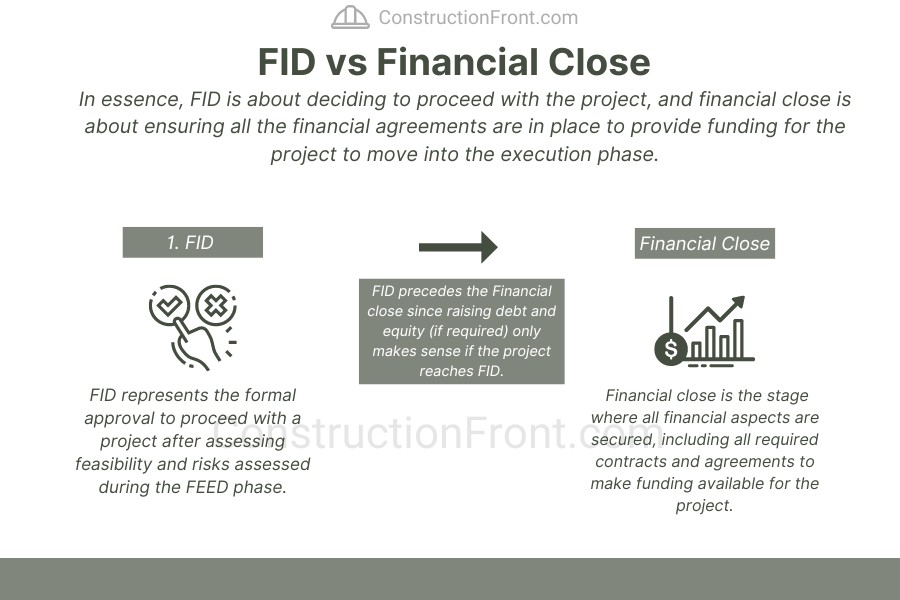

The Final Investment Decision (FID) and Financial Close are distinct stages in the project development process. FID represents the formal approval to proceed with a project after assessing feasibility and risks assessed during the FEED phase.

On the other hand, the financial close is the stage where all financial aspects are secured, including funding, legal and insurance agreements, and other necessary contracts to ensure the project has funds available to proceed with the construction phase.

Therefore, the FID precedes the Financial close since raising debt and equity (if required) only makes sense if the project reaches FID.

In essence, FID is about deciding to proceed with the project, and financial close is about ensuring all the financial agreements are in place to provide funding for the project to move into the execution phase.

Final Investment Decision (FID) - Examples

FID - Example 1 - Ørsted takes FID on am Onshore Wind Farm in Ireland

In early 2024, Ørsted made the final investment decision (FID) on the Farranrory Onshore Wind Farm in Tipperary, marking the company’s 22nd wind farm on the island of Ireland. The decision comes after the project successfully secured a contract in the Irish Government’s Renewable Electricity Support Scheme 3 (RESS 3) auction held in September 2023.

Project Details are shown below:

Farranrory Onshore Wind Farm – Key Features | Details |

Capacity (MW) | 43.2 |

Number of Wind Turbines | 9 |

Location | Tipperary, Munster Province, Ireland |

Operational Date | Summer 2026 |

Suggested Reading: Ørsted makes final investment decision on the Farranrory Onshore Wind Farm

FID - Example 2 - CIP reaches FID for 300 MW onshore windfarm in India

Copenhagen Infrastructure Partners (CIP), one of the largest renewable energy developers in the world, approved the investment for a 300 MW onshore wind project in India. The project is a collaboration with the local contractor Viviid Renewables, an Indian company specializing in development and balance-of-plant services.

FAQ - Final Investment Decision (FID)

FID vs FEED - What is the difference?

FID (Final Investment Decision) is the approval to invest and commit funding to a project, while FEED (Front-End Engineering Design) is the detailed engineering phase that precedes and underpins the FID.

What is a notice to proceed?

A Notice to Proceed (NTP) is a formal document authorizing the start of project activities, typically issued by the client to the contractor and instructing the contractor to commence project mobilization.

Which industries typically use the FEL process and FID?

The Front-End Loading (FEL) process and FID are commonly employed in industries such as construction, energy, infrastructure, and technology, where thorough project planning and investment decisions are crucial.

Need Help?

Do not hesitate to contact us (click here) for specialised advice in construction contracts.