Insurance is crucial in mitigating risks and providing financial protection for various stakeholders involved in construction projects, such as owners, contractors, and financiers. These days, a wide range of policies exist with different coverage purposes.

These guarantees are typically implemented to protect the beneficiary against and limit exposure to construction risks (e.g. accidents on site), comply with regulations (e.g. workers/liability insurance), facilitate project financing (e.g. Delay in Start-Up Insurance), and in many other instances.

Among many variations of financial guarantees, the performance bond is one of the most famous guarantees in the construction industry. But what exactly is it?

A performance bond is a financial guarantee usually requested by owners from contractors to ensure the completion of a construction project according to the contracted terms. It serves as a protective measure for the project owner, ensuring financial recourse (funds) if the contractor fails to fulfill their obligations.

This article will further explore performance bonds, their mechanisms, key features and importance for the industry, pros and cons, and other aspects – keep reading!

Performance Bond: What is it? A Brief Overview

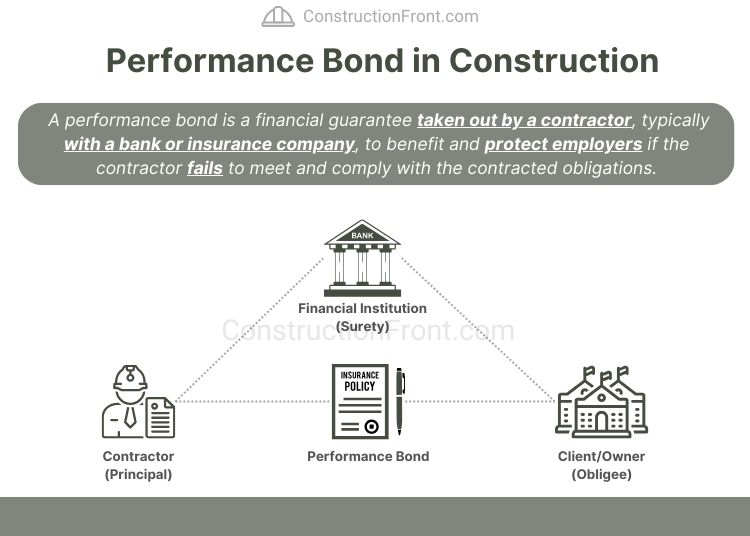

In construction contracts, a ‘performance bond’ is a financial guarantee taken out by a contractor, typically with a bank or insurance company, to benefit and protect employers in the event that the contractor does not meet and comply with the contracted obligations.

Performance Bond - Key Features

The key features of these bonds are summarised in the table below.

Key Features | Description |

Coverage Amount | Specifies the maximum limit of financial protection provided by the bond in case of contractor default or non-performance. |

Contract Details | Outlines the specific terms, obligations, and parameters of the contract covered by the bond, including project scope, timelines, and quality standards. |

Contract Parties |

|

Duration | Specifies the bond’s term, usually aligned with the project timeline and completion expectations. |

Release Conditions | Defines circumstances triggering bond release, such as successful project completion or resolution of disputes. |

Surety’s Obligations | Outlines responsibilities of the surety in case of contractor default, including investigation procedures and potential compensation to the obligee. |

Premium and Costs | Specifies the premium paid by the contractor to the surety and any associated fees or charges related to the bond arrangement. |

Performance Bond - Conditional and Unconditional Terms

According to this paper from the University of Technology of Malaysia, there are two types of performance bonds:

- Conditional Bonds – In this category, the surety (financial institution/insurer) will become liable upon proof of a breach of the terms of the principal contract by the principal (contractor) and the beneficiary (obligee) sustaining loss as a result of such breach.

- Unconditional bonds – In unconditional bonds, also known as “on-demand” bonds, the surety will become liable upon demand made by the beneficiary (obligee), with no necessity for the beneficiary to prove any default by the principal (contractor) in the performance of the principal contract.

Performance Bond - How it Works?

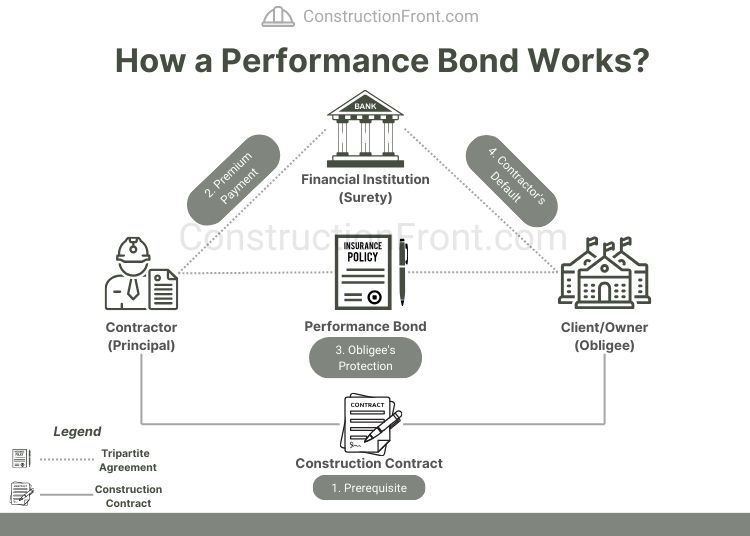

Performance Bonds are tripartite agreements involving contractors (principal), surety (financial institution), and the project owner (Obligee). The dynamics of these instruments are summarised in the paragraphs and picture below:

- Prerequisite – Typically, the Client/Owner will request the performance bond as a prerequisite for executing a construction contract.

- Premium Payment – The Contractor will procure the bond from a financial institution, who will provide it in exchange for a premium who pays a premium for the bond.

- Owner Protection – The Performance Bond must be valid up until project completion.

- Contractor’s Default – If the Owner/Obligee identifies a breach or default by the Contractor, they notify the surety, prompting an investigation into the issue’s circumstances. If the claim is validated, the surety compensates the Obligee for the financial loss incurred due to the Contractor’s non-performance or default (up to the coverage amount).

How to Obtain a Performance Bond?

Acquiring a performance bond involves a structured process that requires coordination between the contractor, surety, and project owner. To obtain a performance bond, contractors typically apply to a surety company, providing details about the project, financial information, and their qualifications.

The surety assesses the contractor’s capacity, financial stability, and capability to fulfil contractual obligations before issuing the bond. Factors such as the contractor’s track record, financial standing, and the project’s complexity influence the bond’s issuance and associated costs.

A solid financial profile and a history of successful project completions can bolster the chances of obtaining a performance bond.

When is a Performance Bond Required?

Performance bonds are often a requisite in the construction industry, especially for large-scale projects. Broadly speaking, the need for a performance bond is driven by various factors, including project complexity, cost, owner’s preferences, and contractual agreements.

Government contracts, in particular, frequently stipulate the necessity of performance bonds to safeguard public interests and investments in construction projects. For example, in the US, the Miller Act, enacted in 1935, mandates that contractors on federal construction projects valued over $100,000 must furnish performance and payment bonds.

Author’s Note: Performance Bonds are a common requirement of Turnkey EPC Contracts, in which the Contractor retains project risks related to engineering/design, procurement, and construction.

Why Performance Bonds Are important for the Construction Industry?

Construction projects are known for their inherent risks, especially when considering complex engineering projects, such as nuclear power plants, manufacturing plants, off-shore construction, and tunnels.

According to the book The Law of Performance Bonds, they were created in the United States in the second half of the nineteenth century to protect public treasuries against contractor default risks on public projects.

Overall, the adoption of these guarantees has significantly increased financial security in the construction industry and provided enhanced protection for owners and financiers. For contractors, acquiring a performance bond can enhance credibility and competitiveness in securing projects. It showcases their commitment to fulfilling contractual obligations, thus instilling confidence in potential clients.

How to Obtain a Performance Bond?

Acquiring a performance bond involves a structured process that requires coordination between the contractor, surety, and project owner. To obtain a performance bond, contractors typically apply to a surety company, providing details about the project, financial information, and their qualifications.

The surety assesses the contractor’s capacity, financial stability, and capability to fulfil contractual obligations before issuing the bond. Factors such as the contractor’s track record, financial standing, and the project’s complexity influence the bond’s issuance and associated costs.

A solid financial profile and a history of successful project completions can bolster the chances of obtaining a performance bond.

What is the typical Coverage Amount in a Performance Bond?

Project owners often demand a performance bond covering the entire (100%) contract value to safeguard against the contractor’s inability to complete projects.

However, obtaining guarantees that match project contract values might pose challenges in a surety insurance market where contractors fully utilize bonding capacity. Further, financial institutions’ appetite may change according to market conditions, which limits the number of contractors able to obtain a performance bond.

An alternative for clients is to flexibilize requirements and accepting coverages below the 100% mark, retaining some contractors’ default risks.

What is the typical duration of a Performance Bond?

Typically, the bond terms are drafted to match the duration with the project’s schedule. However, in some cases, they might be valid for 12 months or other shorter periods. The contractor might be required to renew them accordingly.

When to Release a Performance Bond? Who Releases It?

Performance bonds are usually released upon meeting specific conditions outlined in the contract, which may include the successful completion of the project, adherence to quality standards, settlement of any outstanding disputes or claims, and closing out of project defects.

A common practice in the industry dictates that Performance Bonds typically remain effective for six months after the defect liability period expires.

Suggested Reading: Patent vs Latent Defects – What is the Difference?

The obligee/project owner will release the performance bond once policy/contracts conditions are fulfilled, and will notify the surety. The release of a performance bond normally marks the successful completion of the project, signifying that all contractual obligations have been met satisfactorily.

Performance Bond - Pros and Cons

Pros of Performance Bonds

- Risk Mitigation Tool: Performance bonds act as a safety net, protecting project owners against financial losses in the event of contractor defaults or non-performance. If the contractor fails to fulfill obligations, the bond provides financial compensation, ensuring that the project is completed without additional costs to the owner.

- Enhanced Credibility: Contractors securing performance bonds demonstrate commitment and reliability to complete projects as agreed. This enhanced credibility can positively impact the contractor’s reputation, attracting more opportunities and potential clients seeking assurances of project completion.

- Project Completion Assurance: The presence of a performance bond assures project owners that contracted work will be completed according to agreed terms and conditions. It instils confidence in stakeholders, ensuring timely project delivery and adherence to quality standards outlined in the contract.

- Legal Robustness: Performance bonds offer a robust legal protection to project owners, providing a route for legal recourse in case of contractor default or non-compliance. This legal safeguard ensures that the project owner has a means of financial recourse to cover losses.

Cons of Performance Bonds

- Cost Factor: Acquiring a performance bond involves costs, including premiums paid by contractors to the surety. The expenses incurred can impact the overall project budget, potentially leading to increased project costs for the contractor.

- Stringent Requirements: Sureties often have stringent criteria that contractors must meet to qualify for a performance bond. This includes thorough financial scrutiny, a track record of successful projects, adequate resources, and creditworthiness. Meeting these requirements can be challenging, especially for smaller or newer contractors, limiting their access to projects requiring bonds.

- Impact on Profit Margins: The cost of acquiring performance bonds directly affects a contractor’s profit margins. Higher premiums or the inability to secure bonds may force contractors to increase bid prices to compensate for these expenses or risks, making their bids less competitive compared to those with lower bonding costs.

- Limited Access to Surety might impact competitive procurement: Contractors unable to meet bonding requirements might be excluded from bidding on projects mandating performance bonds. This exclusion reduces competition, potentially affecting project outcomes.

Author’s Note: While performance bonds mitigate the risk of financial loss for project owners, they do not eliminate all the risks associated with contractor’s default.

If a contractor does default, the surety may step in to complete the project or compensate the project owner, but this process can lead to delays, cost overruns, significant legal disputes, and other complications in project completion.

FAQ - Performance Bonds

What is the Cost of a Performance Bond?

As a rule of thumb, performance bond premium costs range from 1% to 4% of the total contracted amount. However, the final cost will depend on:

- The Coverage Amount (Partial / Full Coverage)

- Contractor’s Capability and Financial Position

- Specific Requirements influencing the bond terms

- Others

Is a performance bond refundable?

Typically, performance bond premiums are not refundable. However, there might be some specific occasions in which a partial refund might be achievable (depending on the insurance policy), such as:

- The bond is cancelled before its final coverage period;

- The coverage amount is reviewed (decreased);

- There was no formal submission to the obligee, which means the bond was never put into effect

Surety Bond vs Performance Bond – What is the difference?

Surety bonds and performance bonds are often used interchangeably, but they differ in their objectives:

- Performance Bond: Performance bond is a type of Surety Bond that focuses on ensuring project completion as per contractual terms within the construction industry.

- Surety Bond: Encompasses a broader spectrum, covering various types of bonds ensuring contractual obligations, payments, or legal compliance.

What is the difference between supply bond and performance bond?

A supply bond and a performance bond differ in their primary objectives. While a performance bond guarantees the completion of a project as per contractual terms, a supply bond ensures the timely delivery of materials and supplies necessary for the project’s execution.