Public-Private Partnerships (PPPs), also known as P3s, have emerged as a procurement option for many governments worldwide over the last few decades.

At the heart of this contracting approach, public institutions aim to deliver better public services and improved value for money for taxpayers via structured risk allocation and a ‘whole-of-life’ approach, whereby a private entity is typically responsible for designing, building, financing, operating, and maintaining public assets for a pre-determined period.

PPP agreements can be complex and require significant expertise from several stakeholders. This article will explore this procurement approach further and understand how PPPs work, how they are structured, and their pros and cons – We will also review some real case studies and recent applications.

Public Private Partnership (PPPs) - Defitinion

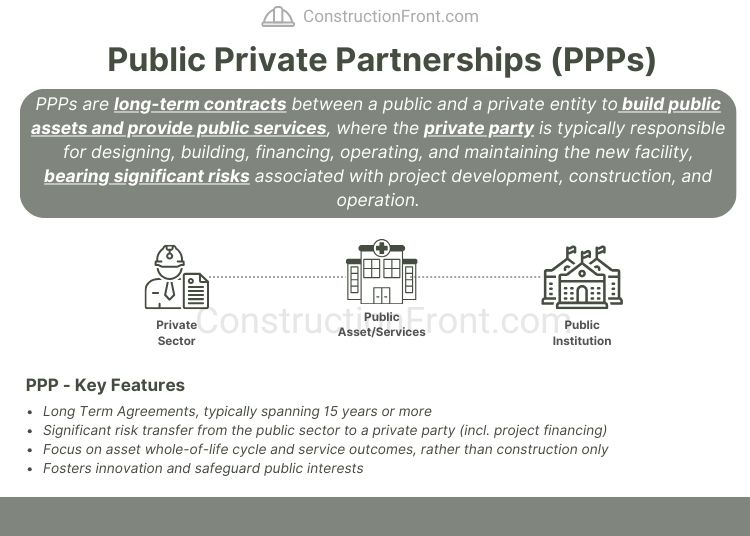

The PPP definition might differ across jurisdictions according to their respective laws, procurement principles, and existing legislation.

Overall, Public-Private Partnerships (PPPs) are long-term contracts between a public institution and a private entity to build public assets and provide public services, which are traditionally delivered by the government (i.e. hospitals, prisons, roads, etc.), where the private sector is typically responsible for designing, building, financing, operating, and maintaining a new facility, bearing significant risks associated with project development, construction, and operation and maintenance.

What is the typical scope of a PPP Contract?

The scope included in a PPP contract might vary to suit government preferences, market conditions, technical and funding constraints, and many other aspects.

Typically, the Government implement a DFBOM (design, finance, build, operate, and maintain) framework, whereby the private partner will be responsible for the following:

PPP / DBFOM Framework | Description |

Design | Based project requirements developed by the public agent, the private partner is responsible for the design development, which involves creating plans and specifications for the infrastructure or service |

Finance | The private entity bears the financial risks associated with the project and is in charge of securing debt and equity for it.. |

Build | Private Partner retains all construction delivery risks (including delays, unforeseen circumstances, design errors, etc). |

Operate | After construction, the private partner is fully responsible infrastructure or service operations for an agreed-upon period. |

Maintain | The private entity is responsible for ongoing maintenance during the operational phase to ensure the infrastructure or service remains in optimal condition. |

However, there are many variations to the DFBOM approach, which can also be considered a PPP, such as:

- Design-Build-Finance-Maintain (DBFM): Typically used when the government already operates an existing asset/network and wishes to extend the existing infrastructure but retain the operation responsibilities. An example is the Eagle Project (Commuter Rail Transit) in Denver, Colorado, USA.

- Design-Build-Finance-Operate (DBFO): In this case, the public partner retains asset maintenance responsibilities, and leave asset construction, financing, and operations with the private party.

- Design-Build-Finance (DBF): DBF models shift the design, construction, and financing duties to the private sector, allowing the government to tap into private expertise and financing capacity resources. The government holds O&M tasks throughout the asset lifecycle.

- Other variations;

Author’s Note:

- For some asset classes, such as healthcare (e.g. Hospital PPPs), while private sector involvement can bring efficiency, innovation, and specialized expertise in construction, technology, or management, retaining operational control allows the government to safeguard critical service delivery aligned with public welfare.

Public Private Partnership (PPPs) - Key Features

Compounding on the definition above, the table below highlights some key features of P3 agreements:

Key Features of PPP Contracts | Description |

Risk Transfer from Public Entity to Private Sector |

|

Long-Term Nature |

|

Public Interest Safeguards |

|

Performance-Based Payments |

|

Whole-of-life Approach |

|

Focus on service outcomes & Innovation and Flexibility |

|

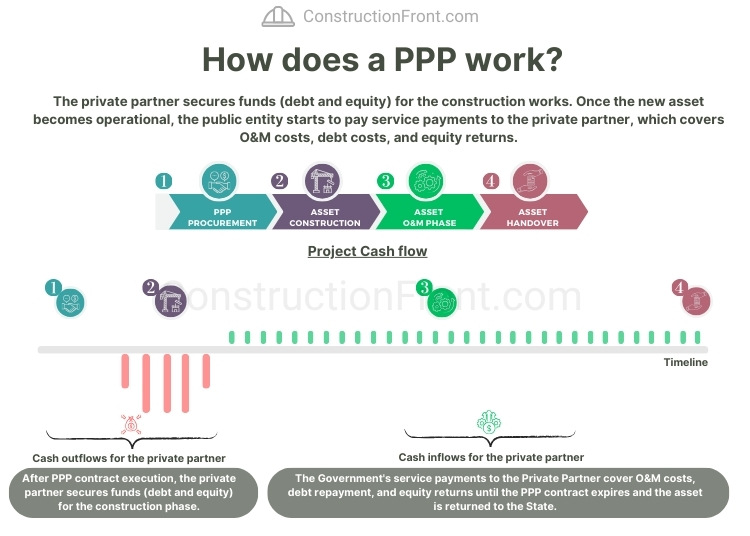

How does a PPP work?

The mechanics behind PPP agreements can be sophisticated and complex, and the primary commercial framework will be detailed in the upcoming section of this article. However, in this section, a high-level explanation of how public-private partnerships work is summarised in the four steps below:

- Step 1 – Procurement: The government initiates a project procurement implementing the PPP framework. Following the existing procurement guidelines in its jurisdiction, it selects a private partner (usually a joint venture) to deliver the project.

- Step 2 – Development and Construction: The chosen private partner creates a Special Purpose Vehicle (SPV) and secures funding via equity and debt. The resources finance design development, construction, and other associated activities (cash outflows for the private partner are predominant in this phase)

- Step 3 – O&M Phase: Once the asset becomes operational, the public entity disburses service payments to the private partner in line with contract requirements (service payments). Typically, service payments will cover overall O&M expenses, contingencies, debt repayments, and equity returns. (Note: In “User Pays” PPPs, the remuneration for the private sector comes from users who will pay a fee to access/use the asset, e.g. toll roads)

- Step 4 – Asset Handover: At the end of the PPP contract (e.g., after 20 years), the asset transitions to the public entity, which assumes O&M responsibilities going forward

Author’s Note:

- An SPV, or Special Purpose Vehicle, refers to a distinct legal entity created for a specific purpose.

- It’s commonly implemented in Public-Private Partnerships (PPPs) and serves to isolate risks associated with the project, ring-fencing the assets and liabilities from the parent company or entities involved.

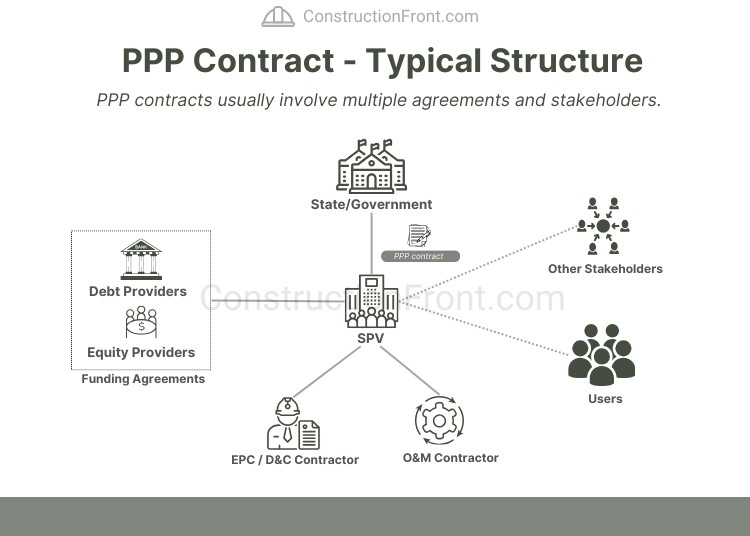

What is the typical structure of a PPP Contract?

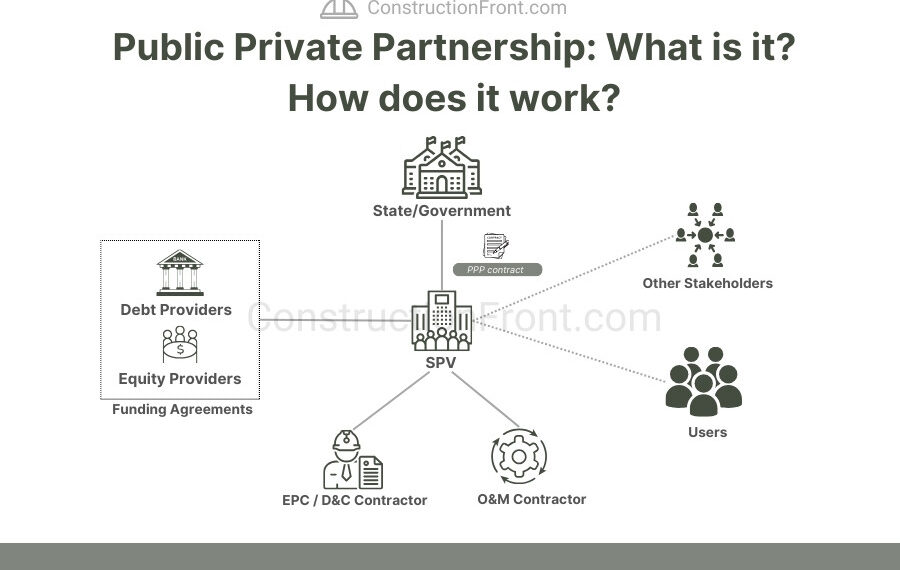

As briefly discussed in the previous section, P3 projects typically involve multiple layers of agreements and several stakeholders, such as:

- Public Institution / Authority / State (Public Partner)

- Special Purpose Vehicle (Private Partner)

- Equity Provider (Successful bidder)

- Debt Providers (Lenders)

- EPC or D&C Contractor

- O&M Contractor

- Users

- Other Stakeholders (Financier Engineer, Insurers, etc)

The graph below and table below summarise the interaction between these key participants.

Upon the procurement finalization, the successful bidder (or successful consortium) will create a Special Purpose Vehicle (SPV) to execute the PPP contract with the Public Partner and raise finance and equity to fund the construction/capital works.

Stakeholder | Role / Details | Typical Contract/Agreements (Summary) |

Public Institution / Authority / State (Public Partner) |

| PPP Contract / Project Agreement |

Special Purpose Vehicle (SPV) |

| PPP Contract, SPV Agreement, Financing Agreements, Parent Company Guarantees (PCGs) Agreements, Others |

Equity Provider (Private Partner) |

| Shareholders’ Agreement, PCGs, Equity Subscription Agreement, Others |

Debt Providers (Lenders) |

| Loan Agreements / Project Financing Agreements |

| Engineering, Procurement, and Construction (EPC) / D&C Contract. (Note: The EPC/D&C terminology might vary according to project – typically EPC contracts are associated with industrial projects (e.g. power plants), whereas the D&C term is commonly associated with civil works (e.g, tunnelling). – In essence, in both agreements the SPV flows downstream all the construction risks. | |

O&M Contractor |

| Operations & Maintenance (O&M) Agreement |

Other Stakeholders (e.g., Financier Engineer, Insurers) |

| Multiple Agreements |

Users |

| N/A (Users typically do not enter into direct contractual agreements within the PPP structure.) |

Insurance policies in PPP Contracts

In PPP contracts, various insurances are commonly used to mitigate risks and protect the stakeholders involved. While their use might vary on each jurisdiction, some typical insurances include:

Construction All Risk (CAR) Insurance: Covers risks associated with the construction phase, including damage to the construction site, materials, and third-party liabilities.

Professional Indemnity Insurance: Protects against claims arising from professional advice or services provided by consultants, architects, or engineers.

Operational All Risk (OAR) Insurance: Covers risks related to the operational phase, including damage to the completed infrastructure, equipment breakdowns, and business interruption.

Third-Party Liability Insurance: Protects against claims arising from injury, property damage, or financial losses to third parties caused by the project.

Environmental Liability Insurance: Covers costs related to environmental damage or pollution caused by the project.

Political Risk Insurance: Protects against risks related to political instability, such as expropriation, currency inconvertibility, or political violence affecting the project.

Revenue Protection Insurance: Protects against revenue shortfalls due to factors beyond the control of the project, such as demand risks or force majeure events.

Force Majeure Insurance: Covers losses caused by unforeseen events beyond the control of the parties involved, such as natural disasters, war, or pandemics.

- Performance Bond: Acts as a guarantee to ensure the private partner fulfills their contractual obligations, providing financial compensation to the public partner if the private partner defaults on their commitments.

Suggested Reading: Performance Bond: What is it and How it Works? (How to Obtain one?)

The Pros and Cons of Public Private Partnerships

The Advantages of the PPP model

There are many pros in implementing the PPP framework to enable infrastructure development, such as:

- Efficiency: Leveraging private sector expertise often leads to more efficient project delivery and innovative solutions.

- Cost Savings: Even though transaction costs are usually higher, PPPs can sometimes save costs and offer better value for money compared to traditional public procurement through efficient project management and innovation.

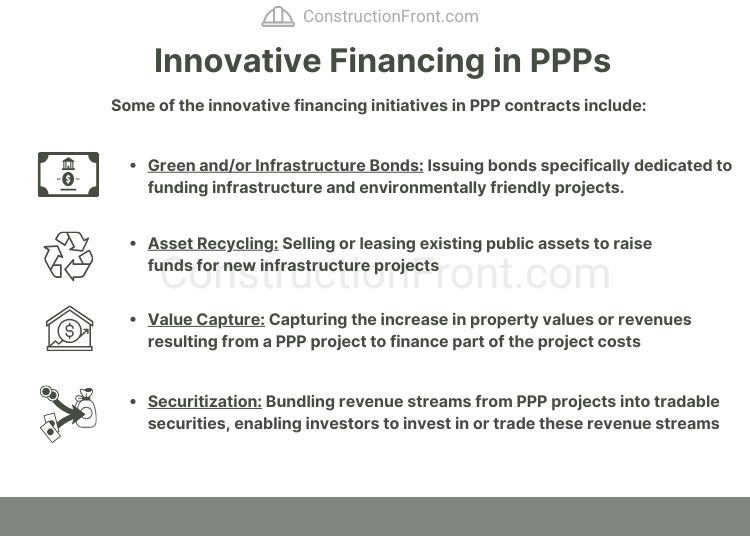

- Innovative Financing: Diverse financing options (bonds, asset recycling, value capture, securitization, etc), including private capital and alternative funding models, can be implemented as detailed in the picture below.

- Off-balance sheet accounting approach: In some jurisdictions, specific accounting approaches allow certain aspects of a PPP project, like assets, liabilities, or transactions, to be excluded from the government’s financial statements. This helps manage large-scale projects’ financial burden on government accounts and preserve fiscal discipline.

- Quality Services: PPPs prioritize service quality due to performance-based contracts and incentivized service delivery.

- Long-term Focus: PPP contracts often span long durations, focusing on asset performance, maintenance, and sustainability.

- Transfer of Technical Expertise: Collaboration between sectors allows the transfer of skills and knowledge.

- Risk Transfer to the private sector: According to the State’s preferences, many risks can be transferred from the public partner to the private entity, allowing each to manage risks according to their capabilities.

The drawbacks and challenges of the PPP model

Some of the disadvantages and challenges associated with P3s are:

- Complexity and Lengthy Procurement Processes: PPPs involve sophisticated contracts, negotiations, multiple stakeholders, and increased regulatory compliance requirements, leading to lengthy procurement and implementation processes. Further, PPP transactions are typically more expensive than “vanilla” procurement options, such as D&C and/or EPC contracts.

- Limited Commercial/Contract flexibility: Even though modern contracts have evolved to incorporate some level of flexibility, change in the scope of work through a variation order instructed by the government might be challenging and time-consuming to implement (e.g. a scope variation might need approval from financiers, giver their debts interests in the project).

Suggested Reading: What is a Variation Order?

- Higher Financing Costs: Private sector financing can sometimes be more expensive than public borrowing, leading to higher overall project costs.

- Service Quality Concerns: When profit motives outweigh service quality, there might be compromises on service standards or corners cut to maximize profits.

- Dependency on the Private Sector: Excessive reliance on private partners can lead to a loss of public control over essential services and infrastructure.

- Political and Regulatory Risks: Changes in government policies or regulations during the project lifespan can impact project economics and feasibility.

- Limited Applicability: PPPs might only be suitable for some projects or sectors, depending on the project’s nature, complexity, or financial viability.

- Potential for Public Backlash: In some jurisdictions, public dissatisfaction due to the perceived privatization of public services or infrastructure might result in opposition to PPP initiatives.

- Risk Allocation Challenges: Misalignment or improper allocation of risks between public and private entities can lead to conflicts, litigation, increased costs, and even bankruptcy of SPV/private partners.

Author’s Note:

- Effective risk allocation is crucial for the success of a PPP project, particularly in instances where the private partner assumes demand risks in greenfield projects.

- Some notable PPP failures worldwide have been attributed to incorrect or overly optimistic assumptions regarding demand, which failed to materialize once the asset became operational, such as the R-3 and R-5 Motorway in Madrid (Spain) and Lane Cove Tunnel in Sydney (Australia)

When are PPP Contracts used?

PPP contracts are typically chosen in specific commercial landscapes or scenarios where they offer advantages over traditional contracts. Governments might opt for a PPP over traditional procurement approach when:

- Long-Term Service Delivery is considered: PPPs cover not just construction but also ongoing operation and maintenance, ensuring a more extended perspective critical for projects requiring lifecycle management, unlike traditional construction contracts focusing solely on the building phase.

- Governments wish to shift risks to the private sector: PPPs allow for the sharing of risks between public and private sectors, enabling each to manage risks according to their expertise, reducing the burden on the public sector compared to traditional contracts.

- Incentive to efficiency and Innovation: Leveraging private sector efficiencies, innovation, and expertise often leads to improved project delivery, cost efficiencies, and innovative solutions, which may not be as prevalent in traditional construction contracts.

- Public Policy Alignment: PPPs can align with public policy objectives by involving private sector capabilities in sectors where innovation or service improvement is a priority, contributing to broader socio-economic objectives.

- Complex Financing Needs or Fiscal/Balance Sheet Constraints: PPPs offer flexibility in financing structures, allowing diverse funding sources, which might not be feasible with traditional construction contracts relying solely on public funds.

PPP - Project Examples

Some of the recent and remarkable PPP projects examples are:

Calcasieu River Bridge Project PPP - USA

Key Info | Details |

Project Name | Calcasieu River Bridge Project |

Location | Louisiana, USA |

Highway | Interstate 10 (I-10) |

Contract Details | Design, Build, Finance, Operate, and Maintain a new Calcasieu River bridge. |

Contract Style | Concession / PPP (DBFOM) |

Contract Value | $2.1 billion (USD) |

Contract Term | 50 years |

Project Scope Summary | New Bridge 8-lane bridge over Calcasieu River |

Further Details: Plenary-Acciona-Sacyr JV wins Bridge PPP Contract in Louisiana (US)

Judiciary Center PPP in Frankfurt - Germany

Project Name | Frankfurt am Main Judiciary Center Expansion |

Scope Summary | Expand the of the Frankfurt Main Judiciary Center, including the construction of 2 new buildings with circa 38,500 square meters. |

Location | Frankfurt, Germany |

Client | Hessian State Office for Construction and Real Estate (LBIH), German Government |

Contractor / SPV | Hochtief |

Contract Value | Non-disclosed |

Contract Style | PPP (Design, Build, Finance, and Operate) |

Contract Term | 30 Years |

What are the alternatives to PPP Contracts?

Alternatives to Public-Private Partnership (PPP) contracts include various approaches for delivering public infrastructure projects. The key difference is that the alternative models below do not include private financing, which means the government fully funds construction of a new asset.

Contract Type / Style | Description | Common Application |

ECI contracts engage contractors in the early design phase, leveraging their expertise for value engineering and risk mitigation before final design. | Early involvement of contractors in design phase for value engineering and risk reduction. | |

EPC contracts assign responsibility to a single entity for the entire project lifecycle, covering engineering, procurement, and construction aspects. | Large-scale projects where a single entity manages engineering, procurement, and construction. | |

D&C contracts involve a single entity handling both design and construction phases for projects with relatively simple design needs. | Projects with straightforward design requirements for streamlined design and construction. | |

CMAR contracts involve a construction manager engaged early, providing input on construction aspects and risk management in complex projects. | Complex projects requiring early construction input and effective risk management. | |

Managing contracts enlist project managers for comprehensive oversight, coordination, and decision-making throughout the project lifecycle. | Projects needing comprehensive project management for coordination and decision-making. | |

Alliance contracts prioritize collaboration, risk-sharing, and a cooperative approach among stakeholders in executing complex projects. | Complex projects emphasizing collaboration, risk-sharing, and cooperative stakeholder approach. | |

FEED contracts involve early-stage engineering design to establish project feasibility, basic engineering, and scope definition before the detailed design phase. | Front-End Engineering Design (FEED) phase for preliminary engineering and project scope (more common in industrial projects) |

Suggested Reading:

- What is an ECI Contract? (And How It Works)

- What is an EPC Contract? (Key Features, Examples, and Tips)

- Design and Construct (D&C) Contracts – How do they Work?

- Construction Manager at Risk (CMaR): What is it? How it Works?

- Managing Contracting vs Construction Manager – Key Differences & Tips

- What is an Alliance Contract? (Pros, Cons & Examples)

- Front-end engineering design (FEED): What is It and How it Works?

FAQ - Public Private Partnership

Government Pay PPP vs User-Pays PPP - What is the difference?

The answer to this question is related to project funding. In summary,

Government-Pay PPP: Government funds the project or services through public budgets or funds, benefiting the public without direct user fees.

User-Pay PPP: Users directly cover costs by paying fees, tolls, or charges for using the infrastructure or services provided.

Are Public-Private Partnerships Good or Bad?

Public-Private Partnerships (PPPs) are an excellent contracting/procurement alternative when implemented under the correct project circumstances, managed by an experienced and skilled team, and used in a favorable economic environment.

However, several factors can contribute to a PPP project failure, such as:

- Poor Risk Allocation: Inadequate assessment and allocation of risks between public and private partners.

- Misaligned Incentives: Divergent interests between public and private partners leading to conflicts.

- Complexity in Contracts: Overly intricate or poorly structured contracts causing management difficulties.

- Political Interference: Changes in government priorities or policies affecting project continuity.

- Legal Framework Robustness: Inadequate or inconsistent legal frameworks impacting contract enforceability and project implementation.

- Legal/Regulatory Changes: Alterations in regulations impacting project feasibility or profitability.

- Financial Instability: Economic downturns affecting private sector funding or viability.

Need Help?

Do not hesitate to contact us (click here) for specialised advice in the construction industry.

Sources

- PPP Arrangements/Types of PPP Agreements | Public Private Partnership (worldbank.org)

- Public Private Partnerships | NSW Treasury

- Australian National PPP Policy Framework (infrastructure.gov.au)

- Canadian Bar Association – Hot or Not: Does the Canadian Public-Private Partnership Legal Framework Attract Foreign Investment? (cba.org)

- PPP Contract Types and Terminology Public Private Partnership (worldbank.org)

- Public-Private Partnerships (P3) | Build America (transportation.gov)

- FHWA – Center for Innovative Finance Support – Design-Build-Finance (dot.gov)

- The APMG Public-Private Partnerships Certification Program (ppp-certification.com)

- Bankrupt PPPs: Is it really so bad? Case study of R-3 and R-5 toll motorways in Spain – ScienceDirect

- Lane Cove Tunnel – Contracts Summary (nsw.gov.au)

- Procurement Methods Guidelines NSW Contruction Leadership Group

- The Routledge Companion to Public-Private Partnerships – Google Books