When construction projects face delays, determining how to fairly recover home office overheads often becomes a complex and contentious issue. One method frequently brought into this discussion is the Eichleay Formula—a recognised tool in some jurisdictions for quantifying indirect costs during periods of project suspension or reduced activity.

The formula is commonly referenced in the context of prolongation cost claims, and has been applied in both formal dispute settings and commercial negotiations. While it can be a useful mechanism, it is not a one-size-fits-all solution. Its application requires a careful understanding of the project’s contractual framework, as well as the specific circumstances surrounding the delay.

In this article, the Eichleay Formula will be explored in further detail—what it is, when it may be used, how it’s calculated, and the circumstances in which it’s most appropriate.

Eichleay Formula - What is it?

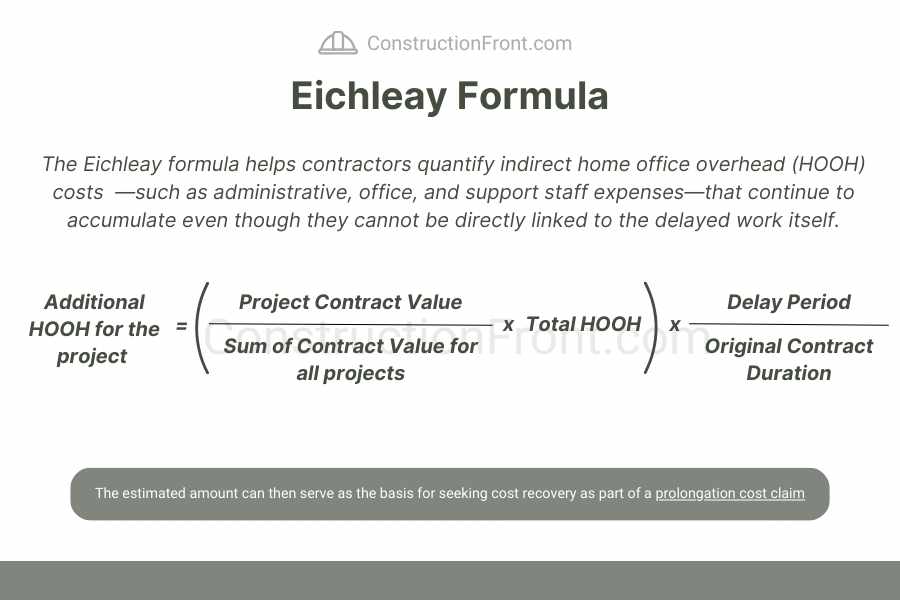

The Eichleay Formula is a method used to estimate home office overheads incurred during periods of project delay. Developed in the 1960s by the U.S. Government’s Board of Contract Appeals in the case of Eichleay Corporation, the formula helps contractors quantify indirect costs—such as administrative, office, and support staff expenses—that continue to accumulate even though they cannot be directly linked to the delayed work itself.

This estimated amount can then serve as the basis for seeking cost recovery as part of a prolongation cost claim, which often arises alongside an extension of time (EOT) claim due an excusable, particularly program float has been exhausted. The formula offers a structured way to allocate a portion of the contractor’s general overhead to the delayed period, based on the proportion between the original contract scope and the length of the delay.

The Eichleay Formula is typically calculated as follows:

Where:

Project Contract Value is the value of the contract for which the claim is being made.

Sum of Contract Value for all projects refers to the total value of all contracts the contractor has during the same period.

Total Home Office Overhead Cost (HOOH) is the total amount of overhead costs incurred by the contractor’s home office during the entire period.

Delay Period is the number of days the project is delayed.

Original Contract Duration is the total duration of the project as initially planned

What Are Home Office Overhead Costs (HOOH)?

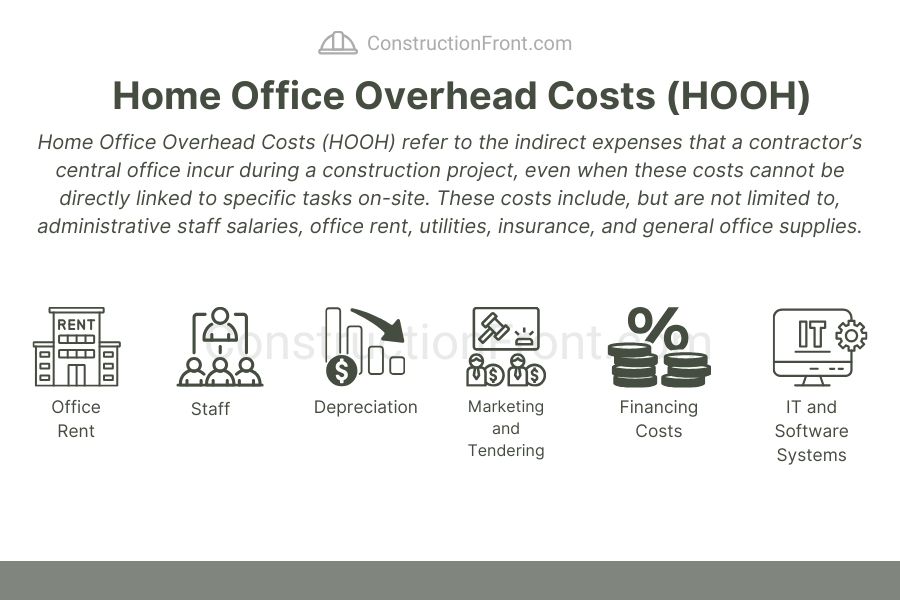

Home Office Overhead Costs (HOOH) refer to the indirect expenses that a contractor’s central office incurs during a construction project, even when these costs cannot be directly linked to specific tasks on-site. These costs include administrative staff salaries, office rent, utilities, insurance, financing costs, general office supplies, etc.

During periods of project delay, these overheads continue to accumulate, and while they may not be attributable to the delayed work itself, they still represent a significant portion of a contractor’s ongoing expenses.

For example, during a project delay, a contractor might need to keep their project management team, consultants, specific software, or office staff on hand for longer than planned, leading to increased costs. At the same time, fixed costs such as office rent, utility bills, and the ongoing maintenance of equipment and software continue to add up, even though these costs aren’t directly tied to the delayed construction work.

Eichleay Approach - Challenges and Considerations

While the Eichleay Formula can be a valuable tool for estimating HOOH during delays, its application presents several challenges that contractors must consider. Below are some key factors to keep in mind:

Complexity in Data Collection: The formula requires accurate and detailed data on both project costs and timeframes. Estimating the overheads during a delay can be difficult, especially when records are not well-maintained or when there is ambiguity regarding what constitutes overhead costs.

Proportional Allocation: The formula allocates a portion of the contractor’s general overheads to the delay period based on the proportion between the original contract work and the delay. This allocation can be problematic in cases where the delay is not evenly distributed across different stages of the project, making it challenging to fairly estimate the overheads for the extended period.

Disputes Over Applicability: The application of the Eichleay Formula may be contested by clients or other stakeholders, particularly if the delay is due to factors outside the contractor’s control. Some jurisdictions may require additional justification for the method’s use, and its acceptance in arbitration or litigation is not always guaranteed.

Overhead Variability: Home office overheads can fluctuate over time due to changes in staffing levels, operational costs, or external factors like inflation. Estimating a fixed amount of overhead for the entire delay period may not accurately reflect these changes, potentially leading to disputes over the claimed amount. Also, even with the similar financial volume, certain types of contracts, such as alliance agreements and public-private partnerships, might require more administrative work than simpler vanilla agreements as D&C contracts.

Pros and Cons of the Eichleay Formula

The table below summarises some of the pros and cons of this approach.

Pros | Cons |

Widely Recognized: An industry-recognized method in legal and contractual contexts. | Limited Acceptance: While widely recognized, it’s not always accepted by all parties, and can lead to disputes. |

Structured and Simple: Provides a clear, straightforward method for estimating overheads. | Assumes Linear Delay Impact: May not accurately reflect the true effect of delays on overheads. |

Supports Negotiations: Offers a clear framework for disputes and can serve as a basis for negotiation benchmarks. | Relies on Detailed Records: Requires thorough, often hard-to-obtain cost and timeline documentation. |

Alternatives to the Eichleay Formula

Given these challenges, contractors may need to consider alternative methods for calculating prolongation costs or negotiating a settlement outside the Eichleay Formula framework. Other approaches may offer more flexibility, especially in complex or extended delays, such as:

Actual Cost Method – The Actual Cost Method involves documenting the specific overhead costs directly incurred during the delay period. Instead of relying on a percentage-based formula, this method accounts for the exact costs that continue to be incurred at the contractor’s home office, such as rent, utilities, or salaries for key personnel who must remain engaged due to the delay.

This method requires detailed tracking and reporting of expenses, making it more accurate for some projects, though it can also be more time-consuming and resource-intensive to compile.Modified Eichleay Formula – Some contractors and consultants use a modified version of the Eichleay Formula, which adjusts the traditional calculation to better reflect the specific characteristics of the delay and the project. For example, the formula may account for variations in overhead rates based on the type of work delayed or the specific duration of the delay, rather than applying a broad, blanket approach. This can provide a more tailored estimate, but like the original Eichleay method, it requires a clear understanding of the project and its costs.

Time-Based Allocation Method – In some cases, contractors may use a time-based allocation method, where overhead costs are distributed across the overall contract period and then adjusted based on the length of the delay. For example, if a project was originally scheduled for 12 months but the delay extends the timeline by 3 months, the overheads could be allocated according to the time impact of the delay, potentially allowing for more accurate cost recovery.

This method may not work as well for projects with complex timelines or fluctuating overhead costs.Benchmarking – Benchmarking involves comparing the contractor’s overhead costs with industry standards or similar projects to estimate the amount that could be reasonably claimed during a delay period. This approach can be helpful when detailed financial data is difficult to obtain or when trying to reach a compromise with a client or stakeholder. However, it may be less precise than other methods and could be subject to interpretation in negotiation settings.

Negotiated Fixed Percentage – For some projects, especially where both parties are seeking an expedited resolution, a negotiated fixed percentage of the contract value can be agreed upon to cover home office overheads during the delay period. This approach is often used when both the contractor and the client wish to avoid lengthy disputes. While it provides a quick resolution, it may not always fairly reflect the actual costs incurred by the contractor.

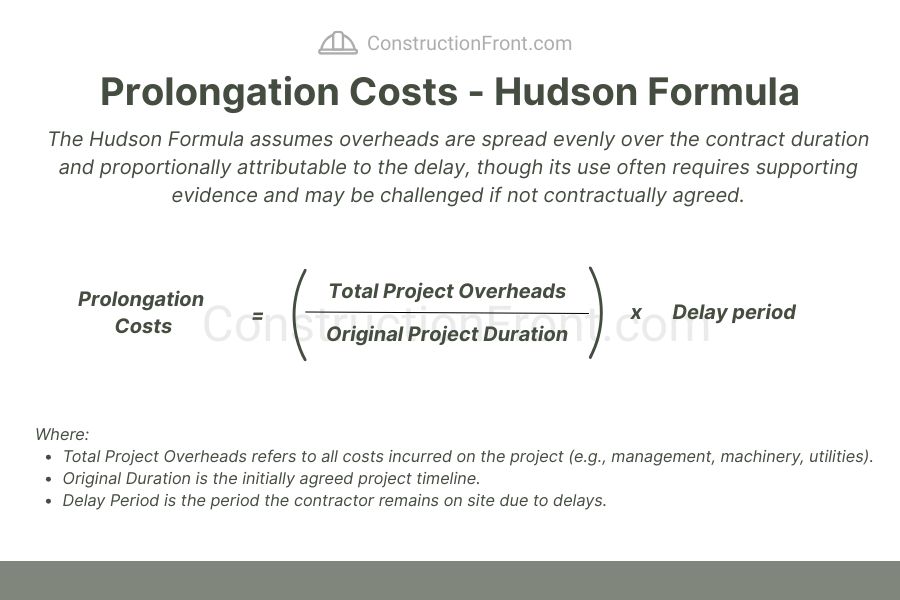

Hudson Formula – The Hudson Formula is another alternative used to calculate home office overheads, particularly in the UK. Unlike the Eichleay Formula, which is based on the proportion of contract value and duration of delay, the Hudson Formula provides a more nuanced approach by using actual cost data to allocate home office overheads (for more detailed background on Hudson formula, read the following article: Prolongation Costs and Claims in Construction Contracts)

The Hudson Formula is designed to account for the actual impact of delays on overheads and is considered more accurate by some contractors as it reflects real-time cost changes. However, it requires extensive documentation of costs and the work completed, which can be difficult to track in some projects. Despite this, it can be more applicable in situations where there is a detailed and transparent record of project costs and where the Eichleay Formula might oversimplify the situation.

Need Help?

Do not hesitate to contact us (click here) for specialised advice in the construction industry.

Sources

Disclaimer: The articles on this blog are for informational and educational purposes only and do not constitute legal advice. While we strive to provide accurate and up-to-date information on construction law, regulations may vary by jurisdiction, and legal interpretations can change over time.