Several alternatives are available when it comes to contracting and procurement methodologies for construction projects, such as design and construction agreements, alliance contracts, managing contractors, and many others. One model often used in the industry for large scale projects is the EPC Contracting framework. But what exactly is it?

EPC Contracts are comprehensive agreements in which a single contractor takes on full responsibility for the engineering (E), procurement (P), and construction (C) phases of a project. These contracts are typically executed on a turnkey lumpsum basis, meaning the contractor delivers a fully operational facility for a fixed price. A significant level of risk transfer characterizes these agreements, with the contractor assuming most of the financial, technical, and scheduling risks associated with the project.

In this article, we will further explore this contracting framework, understanding the pros and cons associated with it, as well as key features and its usability on construction projects.

What is an EPC Contract?

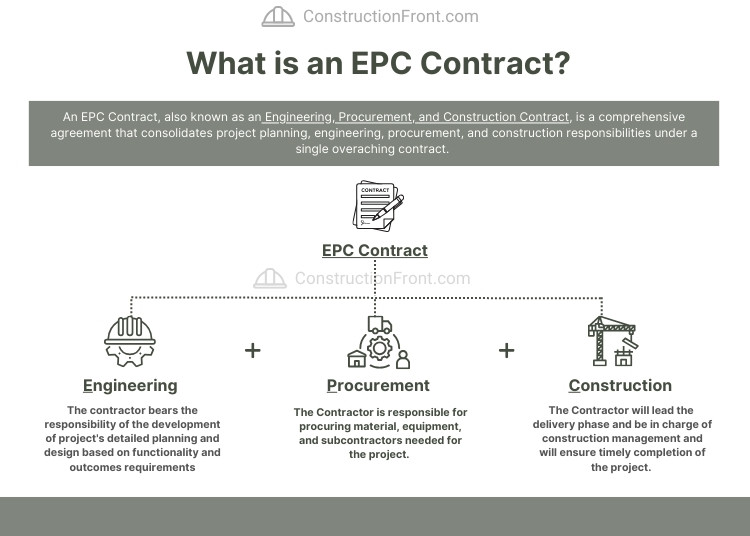

An EPC Contract, also known as an Engineering, Procurement, and Construction Contract, is a comprehensive agreement that consolidates the detailed engineering, procurement of materials and equipment, and construction activities under a single, overarching contract. This contracting model is particularly well-suited for complex industrial and infrastructure projects, offering a streamlined approach where the owner benefits from a single point of accountability.

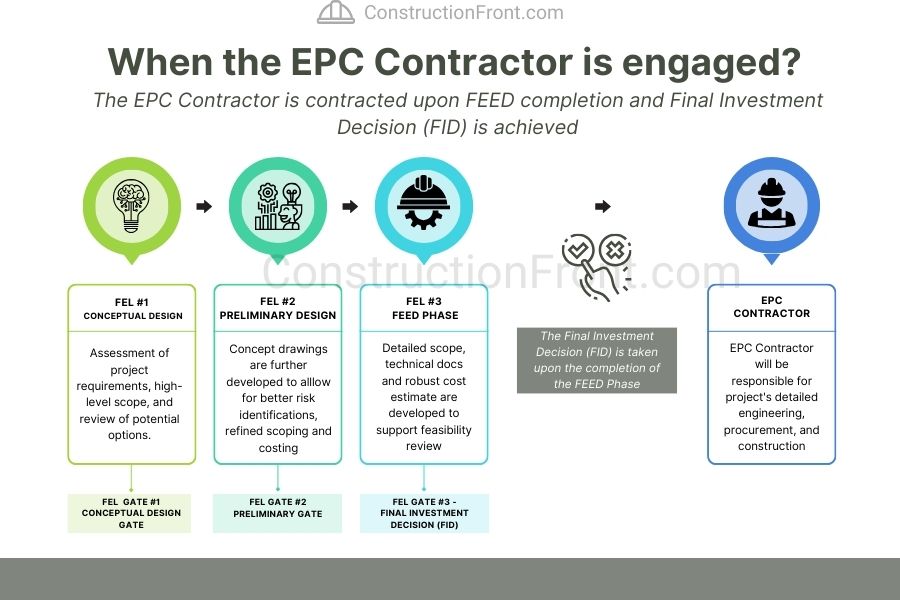

Typically, the EPC Contractor is engaged once the Front-End Engineering Design (FEED) phase is completed and the project has reached the Final Investment Decision (FID) by the owner. At this stage, the owner usually issues a formal Notice to Proceed (NTP), which authorizes the EPC Contractor to commence full-scale project execution.

This framework allows for clear roles and responsibilities, providing greater certainty over cost, schedule, and performance outcomes throughout the project lifecycle.

As the name implies, an EPC Contractor is typically responsible for three core activities within the project delivery:

- Engineering: The contractor oversees the development of detailed project planning and design, ensuring that all technical specifications meet the owner’s required functionality and performance standards.

- Procurement: The contractor manages the entire procurement process, including sourcing, negotiating, and purchasing materials, equipment, and subcontractor services. This also involves coordinating supply chain logistics to secure timely delivery and maintain project momentum.

- Construction: The contractor leads the construction phase, managing onsite activities and resources to ensure the project is executed efficiently, on schedule, and in accordance with quality and safety standards.

When EPC Contracts are used?

EPC agreements are typically employed when owners or investors want to procure a project based on desired functionality and specific performance outcomes rather than a fixed set of detailed designs and drawings.

From the owner’s perspective, the primary rationale is to transfer significant project risks to the EPC Contractor while leveraging their specialized expertise to develop and deliver the project successfully. These risks commonly include delays and extension of time, demurrage, cost overruns (variation claims), and performance shortfalls.

Therefore, it is crucial for owners to carefully evaluate the contractor’s prior experience and track record—not only within the relevant construction sector (such as energy, transport, or manufacturing plants) but also specifically with EPC contracts—given the high level of risk transfer and performance expectations involved.

Usually structured as “turnkey” contracts, EPC agreements mean that once the project is complete, the asset is fully operational and ready for immediate use without requiring further modifications or involvement from the client. Simply put, the client only needs to “turn the key” to start operations.

Due to the relatively early involvement of the EPC contractor in the project lifecycle, these agreements often specify performance requirements for the finished asset rather than highly detailed construction drawings. The EPC contractor then uses its expertise to carry out detailed engineering and determine the most efficient and cost-effective technical solutions.

Below is a detailed table of common project requirements by sector, with key criteria highlighted in bold to help illustrate these concepts clearly.

Niche | Brief Description | Example of Project Requirements |

Energy Infrastructure | Energy-related projects, particularly power generation, where functionality, performance, and safety are essential features. | Construction of a 100 MW wind farm. |

Infrastructure Development | Large-scale infrastructure projects like airports, metro lines, bridges, etc. | Building a major international airport for 10 million Passengers per year. |

Manufacturing Facilities | Factories and plants that require precise equipment installation and operational functionality. | Construction of a chemical plant that can process 100 ton of plastic per year. |

Environmental and Remediation Projects | Environmental projects like wastewater treatment facilities. | Delivery of a wastewater treatment facility that can process at least 10m3 of wastewater per hour. |

Real World Examples

EPC Contracts are widely used across various industries, including energy, oil and gas, mining, and infrastructure. In some cases, they emerge as a “byproduct” of broader agreements such as Public-Private Partnerships (PPPs) or Power Purchase Agreements (PPAs).

In these situations, the developer or owner subcontracts construction works under an EPC contract to transfer and lock in construction risks, providing greater certainty and accountability throughout project delivery.

Some real-world examples are detailed below:

EPC Contracting Strategy

The EPC contracting strategy can vary depending on the client’s preferences and the current market conditions. According to a detailed analysis of EPC agreements, two common contracting models are widely used:

Turnkey EPC with Fixed Price

Turnkey EPC with Target Pricing

EPC Contract - Turnkey with fixed price

In this model, the EPC contractor commits to delivering the entire project scope for a fixed, lump-sum price. Typically, contractors participate in a competitive procurement process, submitting bids based on the owner’s detailed specifications. This approach offers the owner clear cost certainty, as the contract price remains fixed regardless of actual project costs.

EPC Contract - Turnkey with target pricing

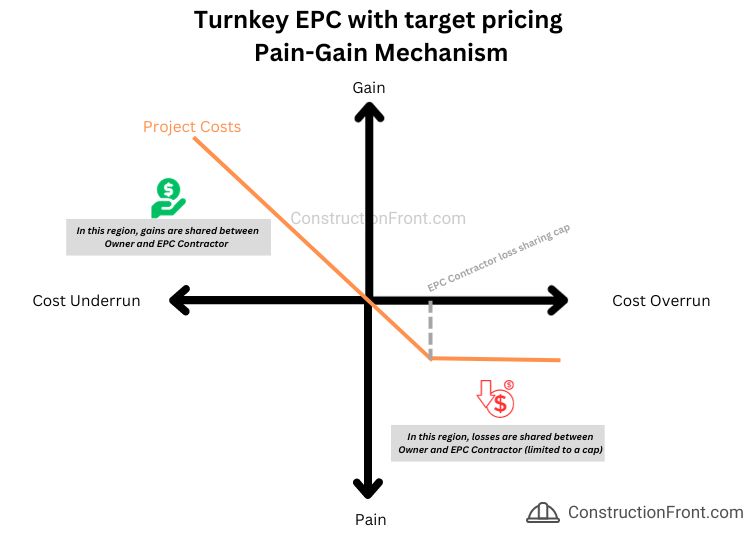

Alternatively, the EPC framework may incorporate a risk-sharing mechanism between the owner and contractor. Like the fixed price model, the contractor undergoes a competitive tender process to deliver the complete scope of work. However, instead of a firm lump sum, a target price is established.

This target price usually includes a “pain-gain” share mechanism, similar to those used in alliance contracts. In simple terms, if the project is completed below the target cost, both parties share the financial gains. Conversely, if costs exceed the target, the owner and contractor share the losses, with the contractor’s liability typically capped at a predetermined loss-sharing limit (see the diagram below for further details).

Key Features in EPC Agreements

Some of the key features of this contracting framework are detailed in the table below.

EPC – Key Features | Description |

Outcome / Performance Based | EPC contracts are typically procured focusing on achieving specific project and performance and requirements. |

Single Touch Point / Responsibility | A single entity (the EPC contractor or EPC JV Contractor) is responsible for all aspects of the project (engineering, procurement, and construction). This simplifies communication with the client/owner and almost extinguishes interface risks (for the owner) |

Risk Transfer – Increased Cost, Program, and Scope Certainty for the owner | EPC contracts are usually procured on a turnkey lump sum basis, offering cost, program and scope certainty to the owner. There is a significant level of risk transfer from the owner to the EPC Contractor. |

Use of Performance Guarantees | These contracts normally include performance guarantees of meeting performance and quality standards specified at the time of procurement. It provides assurance that the project will be perform to the satisfaction client’s requirements. In case of non-compliance, the guarantor may be required to rectify the deficiencies or provide compensation as per the terms of the contract. It can be a Parent Company Guarantee (PCG), Bank Bond (i.e. Performance Bond), and other alternatives available on the market. |

Liquidated damages and Liability Caps | Given the level of risk transfer, EPC Contractors normally request liability caps to limit their exposure. Typical caps are: • Usually capped at 100% of the Contract Price • Sub-caps of 20% of the Contract Price on delay (They might vary in accordance with jurisdictions, market appetite, and parties involved in the process). |

Defect Liability | The defect liability period (DLP) to rectify construction defects usually varies from 12 to 24 months following achievement of practical completion. |

Intellectual Property | Intellectual property with regards to technology developed for the project are typically held by the Owner, and the IP use by the EPC contractor without owner’s consent might trigger indemnities. |

Force Majeure | Typically, the EPC contractor can be released from some of its obligations in case of force majeure events (wars, strike, riots, floods, etc.) |

Termination | EPC Contractors have very limited termination rights, whereas owners usually have broader rights. |

EPC Contract - Insurances and Guarantees

In an EPC contract, several types of insurance are typically involved to mitigate risks for the parties involved. These guarantees are crucial to protect against potential liabilities, damages, and unexpected events that may occur during the project lifecycle.

Some of the common insurances policies and guarantees include:

- Contractor’s All Risk (CAR) Insurance: This insurance is usually obtained by the contractor and covers risks related to construction, such as damage to the works, materials, and equipment on-site. It often includes coverage for third-party liabilities arising from the construction activities.

- Professional Indemnity Insurance: Design professionals involved in the project, such as architects or engineers, might carry this insurance. It protects against claims arising from professional errors, omissions, or negligence in design or advice.

- Public Liability Insurance: This insurance covers third-party bodily injury or property damage caused by construction activities (i.e. settlement caused in adjoining properties).

- Employer’s Liability Insurance: covers employee claims for work-related injuries or illnesses. It’s usually mandatory in most jurisdictions.

- Delay in Start-Up (DSU) Insurance or Advanced Loss of Profits (ALOP): This insurance protects against financial losses due to delays in project completion caused by covered risks. It covers additional expenses and loss of expected revenue during the delayed period.

- Performance Bonds or Guarantees: While not insurance in the traditional sense, these financial instruments are often required in EPC contracts. They ensure that the contractor performs the work specified in the contract and compensate the owner if the contractor fails to meet contractual obligations.

The use of other specific insurances and their respective terms can vary based on the nature of the project, its location/jurisdiction, contractual agreements, and the parties’ preferences. It’s crucial for all parties to thoroughly review and understand the insurance provisions in the EPC contract to ensure adequate coverage and risk management throughout the project.

Prons and Cons of EPC Contracts

As with every contracting methodology, EPC contracts come with several pros and cons that are detailed below.

Advantages of EPC Contracts

Some of the key advantages of EPC agreements include:

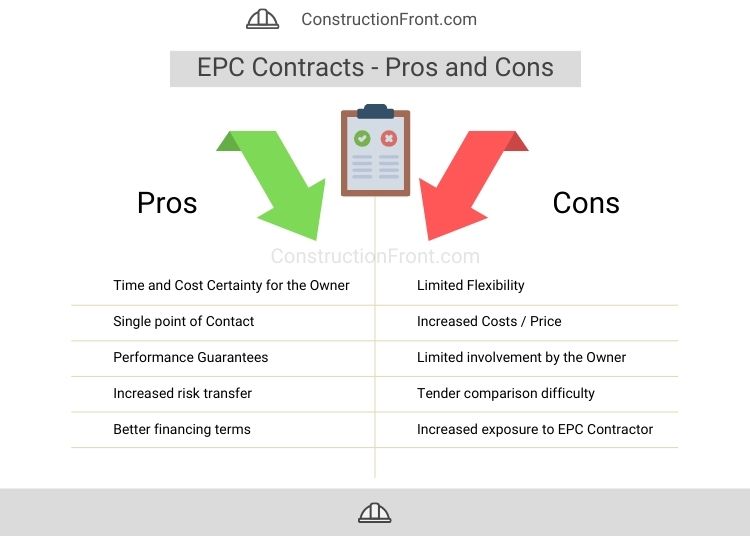

- Time and Cost Certainty for Project Owners: EPC contracts are usually structured as lump-sum agreements, providing owners with a clear understanding of the project cost upfront. They also include well-defined liquidated damages and indemnification clauses to protect the owner in case of delays or performance issues caused by the EPC contractor.

- Single Point of Contact: By appointing one contractor responsible for engineering, procurement, and construction, the owner benefits from streamlined communication and simplified project management—particularly valuable for owners or asset operators with limited experience in managing complex construction projects.

- Performance Guarantees: EPC contracts often incorporate performance guarantees, such as performance bonds, giving investors and owners confidence that the completed asset will meet agreed-upon quality, functionality, and operational standards.

- Significant Risk Transfer to EPC Contractors: These agreements transfer a substantial portion of project risks—including schedule, cost overruns, and performance—to the EPC contractor, reducing the owner’s exposure.

- Enhanced Financing Opportunities: A well-structured EPC contract with an experienced contractor can improve the project’s bankability, often resulting in more favorable financing terms by providing lenders with greater assurance against contractor-related defaults, which may be crucial for projects under public private partnerships and power purchase agreement arrangements.

Disadvantages and Risks of EPC Contracts

- Limited Flexibility for Changes: Once the EPC contract is in place, modifying the project scope or specifications can be difficult and costly. Changes often lead to additional expenses and significant variation and extension of time claims, limiting the owner’s ability to adapt as the project evolves.

- Higher Costs: Due to the extensive risk transferred to the EPC contractor, these contracts often come with a premium price. Contractors factor in risk contingencies, which can result in higher overall project costs compared to other contracting methods.

- Reduced Owner Involvement: EPC contracts generally limit the owner’s direct involvement in day-to-day project decisions. While this streamlines management, it can also reduce the owner’s control and influence over key aspects of the project execution.

- Challenges in Tender Comparison and Assessment: Since EPC bids are usually based on performance and output requirements rather than detailed designs, contractors may propose different technical solutions. This variation can make it difficult for owners to perform straightforward “like-for-like” comparisons during tender evaluation.

- Concentrated Commercial Exposure to the EPC Contractor: Owners bear significant commercial risk concentrated in a single EPC contractor. Distressed projects can lead to substantial financial challenges, including losses that may exceed liability caps. Additionally, the quality and expertise of the selected EPC contractor can significantly impact financing conditions and project viability.

EPC vs EPCM - What is the difference?

When clients, owners, or investors possess greater expertise and prefer to maintain a higher level of involvement in project development and decision-making, they often opt for the EPCM framework.

EPCM stands for Engineering, Procurement, and Construction Management. In this model, the EPCM contractor functions primarily as an advisor to the owner, providing support and guidance throughout the project lifecycle. Key responsibilities typically include:

Refining technical requirements and defining the scope of work

Advising on design development and value engineering opportunities

Assisting with critical procurement activities

Managing overall construction delivery, including cost and schedule control, financial oversight, and contract administration

While the EPC contracting approach shares similarities with a Managing Contractor Agreement, the EPCM model aligns more closely with traditional construction management contracts.

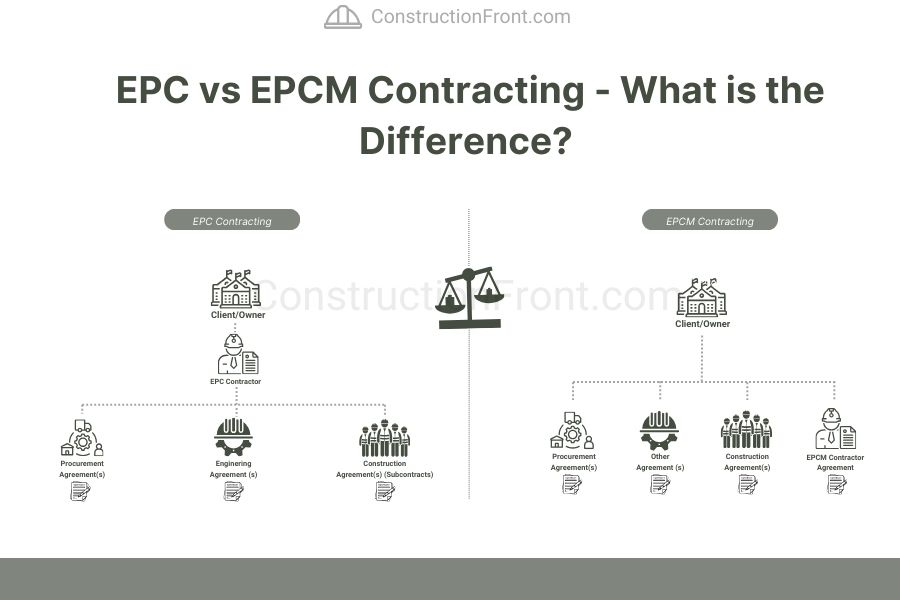

A major distinction lies in commercial and legal exposure: in EPCM contracts, the owner directly holds contracts with all engineering, procurement, and construction subcontractors. The EPCM contractor’s role is advisory, with significantly less commercial risk compared to EPC contractors who take on full responsibility for project delivery (see typical contracting framework below).

Suggested Reading: EPC vs EPCM – What is the difference?

EPCM - Practical examples

EPCM Contracts are commonly used across a variety of sectors such as mining, infrastructure, and industrial projects, especially when owners want greater involvement in project decision-making and management.

Often, EPCM arrangements arise as part of larger frameworks like Joint Ventures or Development Agreements, where the owner prefers to retain direct contracts with suppliers and contractors while engaging an EPCM contractor to provide expert management and advisory services. Some real-world examples are detailed below:

Conclusion

EPC Contracts offer a compelling solution for owners who prefer to procure projects based on performance and outcome criteria rather than relying on fully developed designs and drawings. This approach provides the advantage of a single point of responsibility, clear performance guarantees, and substantial risk transfer, making EPC contracts an attractive option for those seeking well-defined and commercially robust agreements.

That said, EPC Contracts also present certain challenges. They tend to limit flexibility for design changes, can lead to higher costs due to risk premiums, and often restrict the owner’s direct involvement in key project decisions.

For clients with strong in-house project and engineering management capabilities who desire greater control over project execution, EPCM Contracts present a viable alternative. By enabling more active owner participation and advisory support, EPCM offers a flexible framework that balances professional oversight with owner engagement throughout the project lifecycle.

Need Help?

Do not hesitate to contact us (click here) for specialised advice in the construction industry.

Disclaimer: The articles on this blog are for informational and educational purposes only and do not constitute legal advice. While we strive to provide accurate and up-to-date information on construction law, regulations may vary by jurisdiction, and legal interpretations can change over time.